ITI FLEXI CAP FUND

(An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocks.)

Product Review Note 29th December 2023

|

Inception Date | 17th Feb 2023 | ||

|

Category | Flexi cap Fund | ||

|

Benchmark Index | Nifty 500 Total Return Index | ||

|

Monthly AAUM AUM |

₹ 509.52 Crores ₹ 543.60 Crores |

||

|

Minimum Application Amount: | ₹ 5,000/- & in multiples of ₹ 1/- thereafter | ||

|

Load Structure | Entry Load: Nil |

||

| Exit Load: 1% if redeemed or switched out on or before completion of

12 months from the date of allotment of units; · Nil, if redeemed or switched out after completion of 12 months from the date of allotment of units. |

||||

|

Fund Manager | |||

|

||||

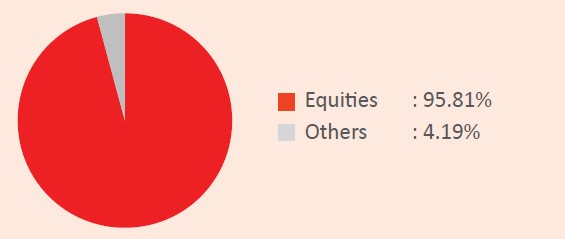

- Well diversified equity fund that seeks to invest across Market capitalization from Large to Mid to Small Cap Companies.

- The fund aims to capture stability of large cap companies and growth potential of mid and small cap.

- The fund does not have any bias towards any market cap or sector.

- It follows top down approach for sector selection, bottom up approach for stock selection & may place tactical allocation across market cap.

- The investment style is Growth at Reasonable Prices.

- The fund may deploy money in debt market to avail opportunities.

- Going forward while all eyes are on the General Elections, all the three elements of the capex cycle (Housing, Corporate Capex & Govt Capex) are now firing and hence the potential global slowdown should have limited impact on India. A combination of a strong pent-up demand for housing, above average affordability and 12-year low unsold inventory should drive a multi-year virtuous housing cycle. Ditto for corporate capex with all time low D/E ratio for Indian corporate, along with a decade high capacity utilisation level and well capitalised banking system should drive corporate capex. Govt Capex could slowdown but private capex pick-up should more than offset.

- Unlike every year, the budget would be a Vote on Account in this financial year. However, considering election year, one cannot rule out a populist measures being announced in the budget. During 2019-20, the first interim budget of the incumbent government saw various measures being implemented like PM Kisan Yojana – transferring Rs.6000 per annum x ~12 crore farmers entailing an outlay of Rs.75,000 crore per annum. These sort of measures are expected to not only provide spending impetus at the lower strata of the society but is also expected to reinforce the positioning of the incumbent Government with a strong majority.

Long-term outlook remains intact:

Dec-23 |

Nov-23 |

Oct-23 |

||

| Large Cap | 42.58% |

40.71% |

42.44% |

|

| Mid Cap | 17.30% |

20.87% |

19.02% |

|

| Small Cap | 35.93% |

33.52% |

34.33% |

|

| Market cap classification as per AMFI. | ||||

| Sector | Dec-23 |

Nov-23 |

Oct-23 |

| Financial Services | 25.05% |

23.99% |

24.46% |

| Capital Goods | 17.13% |

19.01% |

18.27% |

| Automobile And Auto Components | 7.23% |

7.92% |

10.81% |

| Oil, Gas & Consumable Fuels | 5.60% |

5.20% |

4.70% |

| Information Technology | 4.67% |

5.01% |

3.00% |

| The portfolio of the scheme is subject to changes within the provisions of the Scheme Information document of the scheme. Please refer to the SID for investment pattern, strategy, risk factors & the asset allocation. Please refer to the factsheet for more details. | |||

Dec-23 |

Nov-23 |

Oct-23 |

|

| Average P/E | 44.95 |

40.04 |

35.59 |

| Average P/B | 5.92 |

6.19 |

5.58 |

| No. of stocks: | 71 |

64 |

63 |

| % of top 5 holdings | 15.27 |

16.37 |

16.75 |

| % of top 10 holdings | 25.02 |

26.89 |

27.38 |

| The portfolio of the scheme is subject to changes within the provisions of the Scheme Information Document (SID) of the scheme. Please refer to the SID for investment pattern, strategy, risk factors & the asset allocation. Please refer to the factsheet for more details. | |||

| This product is suitable for investors who are seeking*: |

|

Scheme Riskometer

|

|

Benchmark Riskometer Nifty 500 TRI

|

Disclaimer The investment strategy of the scheme may change from time to time and shall be in accordance with the strategy as mentioned in the Scheme Information Document of the scheme. The views contained herein are not to be taken as an advice or recommendation to buy or sell any particular stock. The above information must be read along with the scheme features & riskometer for better understanding of the product. This should not be construed as an investment advice. Investors may consult their Mutual Fund Distributor for other details. It should be noted that value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements. Past performance may or may not be sustained in future.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.