ITI Banking & PSU Fund^^

(An open ended debt scheme predominantly investing in debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds. Relatively High interest rate risk and relatively low credit risk)

Product Review Note 29th December 2023

|

Inception Date | 22-Oct-20 |

|

Category | Banking and PSU Fund |

|

Benchmark Index | CRISIL Banking and PSU Debt Index |

|

Monthly AAUM AUM |

₹ 30.28 Crores ₹ 30.36 Crores |

|

Minimum Application Amount: | ₹ 5,000/- & in multiples of ₹ 1/- thereafter |

|

Load Structure | Entry Load: Nil Exit Load: Nil |

|

Fund Manager |  Mr. Vikrant Mehta (Since 18-Jan-21) Total Experience: 28 years |

- The investment objective of the Scheme is to generate income / capital appreciation through investments in debt and money market instruments consisting predominantly of securities issued by entities such as Scheduled Commercial Banks (SCBs), Public Sector undertakings (PSUs), Public Financial Institutions (PFIs) and Municipal Bonds. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

- Predominantly invests in debt instruments of Banks, Public Sector Undertakings, Public Financial Institutions & Municipal bonds.

- Active fund management based on market outlook.

- Duration of the fund will generally be in the range of 1 - 4.5 years during secular times.

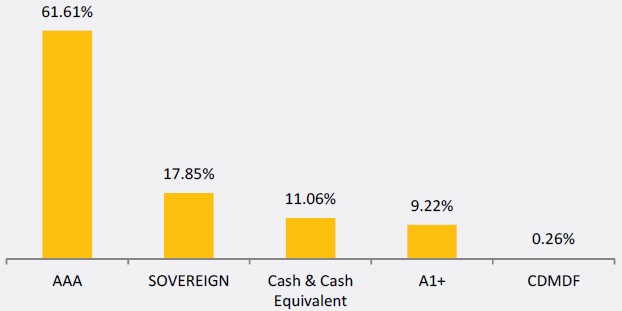

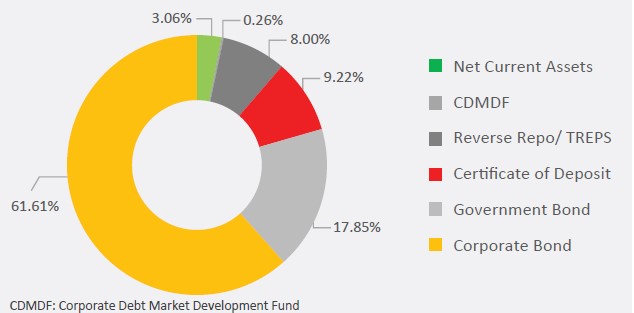

- Fund would majorly be invested in AAA/ Sovereign bonds at all points of time & will not invest in perpetual bonds.

- Strict internal controls, limits, & compliance to minimize risk.

- The US Fed expectedly held the benchmark rate in the 5.25% - 5.5% target range in the FOMC meeting in December 2023, and importantly projected 75 bps (100 bps = 1.0%) of rate cuts in 2024. Furthermore, though the Fed decided to continue with the pace of quantitative tightening (QT), the FOMC minutes indicated discussions on when to flag the balance sheet change.

- Markets have welcomed the “Fed pivot” and the 10-year US Treasury bonds closed largely unchanged for 2023. The nearly 1.0% fall from the 2023 peak in the last 2 months of the year seems to have left less room of error and puts the market at significant odds from the Fed’s policy rate forecast trajectory.

- The RBI expectedly kept the repo rate as well as the policy stance unchanged at the December 2023 MPC meeting. The tone of the MPC was balanced with the focus on the need to sustain the disinflation path to ensure a durable alignment of CPI to the 4.0% inflation target being partly offset by cautioning the risk of overtightening, especially when large structural changes, geopolitical and geoeconomic shifts are taking place.

- Since November 2023 we have increased duration across portfolios as global environment became less hostile and anticipated the Fed to acknowledge the same. We moderately further added duration in December 2023 and expect our portfolios to maintain higher maturity over the coming months as compared to the past year.

- Prospects of a Fed rate cut in 1H CY2024, expected policy continuity at the Centre post the India’s State elections results and potential inflows from India’s inclusion in the global EM bond index remain tailwinds for Indian bonds. We expect any sharp increase in yields (not a base case) to be bought into and expect rates to trade lower into FY2025. Long maturity bonds are expected to find favour with long term investors over the coming months and we see some merit in taking advantage of this seasonality.

- Global policy rates are at peak levels or near peak levels and policy rates are expected to end lower by end-2024. The current environment seems suitable for duration products such as Dynamic Bond funds and Banking & PSU Debt funds which are well positioned to take advantage of a falling interest rate cycle and can deliver superior risk adjusted returns as compared to non-market linked fixed rate products.

Dec-23 |

Nov-23 |

Oct-23 |

|

| AUM (in ₹) | 30.36 Cr |

30.19 Cr |

30.11 Cr |

| Yield to Maturity | 7.48% |

7.48% |

7.37% |

| Modified Duration | 2.93 Years |

2.49 Years |

0.82 Years |

| Average Maturity | 6.63 Years |

5.24 Years |

0.95 Years |

| Macaulay Duration | 3.06 Years |

2.59 Years |

0.87 Years |

Credit risk of scheme |

Relatively Low (Class A) |

Moderate (Class B) |

Relatively High (Class C) |

Interest Rate Risk |

|||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III |

| This product is suitable for investors who are seeking*: |

|

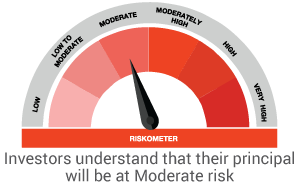

Scheme Riskometer

|

|

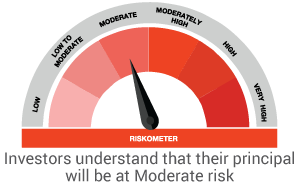

Benchmark Riskometer CRISIL Banking and PSU Debt Index

|

(^formerly known as ITI Banking & PSU Debt Fund w.e.f Dec 15, 2023)

Disclaimer The investment strategy of the scheme may change from time to time and shall be in accordance with the strategy as mentioned in the Scheme Information Document of the scheme. The views contained herein are not to be taken as an advice or recommendation to buy or sell any particular stock. The above information must be read along with the scheme features & riskometer for better understanding of the product. This should not be construed as an investment advice. Investors may consult their Mutual Fund Distributor for other details. It should be noted that value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements. Past performance may or may not be sustained in future.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.