Aditya Birla Sun Life Credit Risk Fund |

|

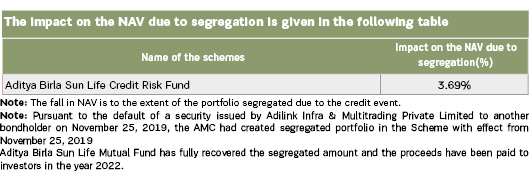

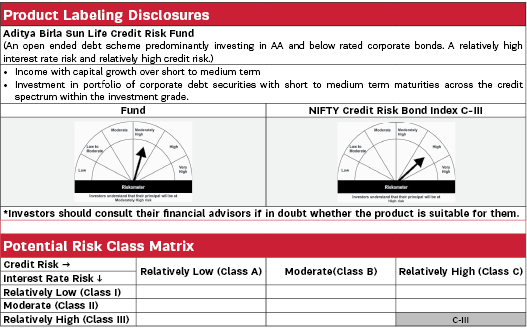

| An open ended debt scheme predominantly investing in AA and below rated corporate bonds. A relatively high interest rate risk and relatively high credit risk. Number of Segregated Portfolios – 1 |

| Data as on 29th December 2023 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the Scheme is to generate returns by predominantly investing in a portfolio of corporate debt securities with short to medium term maturities across the credit spectrum within the investment grade. The Scheme does not guarantee/indicate any returns. There can be no assurance that the Schemes' objectives will be achieved. | |

|

| Fund Manager | |

|---|---|

| Ms. Sunaina Da Cunha, Mr. Mohit Sharma & Mr. Dhaval Joshi |

| Managing Fund Since | |

|---|---|

| April 17, 2015, August 06, 2020 & November 21, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 8.7 years, 3.4 years & 1.1 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load** | In respect of each purchase/switch-inof Units, upto 15% of the units may be redeemed / switched out without any exit load from the date of allotment.Any redemption in excess of the above limit shall be subject to the following exit load: For redemption / switch-out of units on or before 1 year from the date of allotment - 3.00% of applicable NAV. For redemption /switch-out of units after 1 year but on or before 2 years from the date of allotment - 2.00% of applicable NAV. For redemption / switch-out of units after 2 year but on or before 3 years from the date of allotment - 1.00% of applicable NAV. For redemption /switchout of units after 3 years - Nil **Exit Load is NIL for units issued in Reinvestment of IDCW. |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 1.58% |

| Direct | 0.68% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 993.98 Crores |

| AUM as on last day | 991.15 Crores |

| Date of Allotment | |

|---|---|

| April 17, 2015 |

| Benchmark | |

|---|---|

| NIFTY Credit Risk Bond Index C-III |

| Other Parameters | |

|---|---|

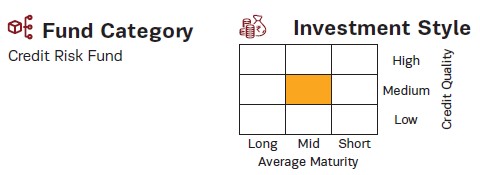

| Modified Duration | 2.10 years |

| Average Maturity | 2.77 years |

| Yield to Maturity | 8.54% |

| Macaulay Duration | 2.19 years |

| Calculation of YTM doesn't include Stressed Assets (ITPCL). Refer the Annexure for Update on Stressed Assets. | |

|

|

||

|---|---|---|

Regular Plan |

Direct Plan |

|

| Growth | 18.3473 |

19.8413 |

| IDCW$: | 11.1071 |

12.0256 |

| Bonus: | - |

19.8403 |

| $Income Distribution cum capital withdrawal | ||

| Application Amount for fresh subscription | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 100/- |

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

| Fixed rates bonds - Corporate | 60.67% | |

| Tata Power Company Limited | 5.04% | CARE AA |

| Century Textiles & Industries Limited | 5.00% | CRISIL AA |

| Tata Projects Limited | 4.96% | IND AA |

| Steel Authority of India Limited | 3.04% | CARE AA |

| GIC Housing Finance Limited | 3.02% | ICRA AA |

| JSW Steel Limited | 3.00% | ICRA AA |

| Sk Finance Ltd | 2.64% | CRISIL A+ |

| Avanse Financial Services Ltd | 2.52% | CARE AA- |

| Godrej Industries Limited | 2.51% | ICRA AA |

| Nexus Select Trust | 2.51% | ICRA AAA |

| Adani Energy Solutions Limited | 2.51% | IND AA+ |

| ONGC Petro Additions Limited | 2.50% | ICRA AA |

| Yes Bank Limited | 2.50% | CRISIL A |

| GR Infraprojects Limited | 2.48% | CARE AA+ |

| CreditAccess Grameen Limited | 2.07% | IND AA- |

| ONGC Petro Additions Limited | 2.02% | ICRA AA |

| Summit Digitel Infrastructure Private Limited | 2.02% | CRISIL AAA |

| JM Financial Products Limited | 2.01% | ICRA AA |

| Arka Fincap Limited | 1.81% | CRISIL AA- |

| DLF Cyber City Developers Limited | 1.59% | CRISIL AA |

| Summit Digitel Infrastructure Private Limited | 1.46% | CRISIL AAA |

| Andhra Pradesh Capital Region Development Authority | 1.34% | CRISIL BBB (CE) |

| Belstar Microfinance Private Limited | 0.70% | CRISIL AA |

| Tata Motors Limited | 0.51% | ICRA AA |

| U.P. Power Corporation Limited | 0.44% | BWR AA-(CE) |

| Tata Motors Finance Solutions Limited | 0.30% | CRISIL AA |

| Power Finance Corporation Limited | 0.12% | CRISIL AAA |

| REC Limited | 0.05% | ICRA AAA |

| NTPC Limited | 0.01% | CRISIL AAA |

| Issuer | % to Net Assets |

Rating |

| Government Bond | 20.31% | |

| 7.18% GOVERNMENT ON INDIA 14AUG2033 GSEC | 12.11% | SOV |

| 7.26% GOVERNMENT OF INDIA 06FEB33 | 6.59% | SOV |

| 7.10% GOVERNMENT OF INDIA 18APR29 | 1.01% | SOV |

| 7.06% GOI 10APR28 | 0.50% | SOV |

| 7.38% GOI 20JUN2027 | 0.10% | SOV |

| Floating rates notes - Corporate | 12.67% | |

| JM Financial Credit Solutions Ltd | 3.75% | ICRA AA |

| Varanasi Sangam Expressway Private Limited | 2.61% | IND AAA |

| Vedanta Limited | 2.01% | CRISIL AA- |

| DME Development Limited | 0.43% | CRISIL AAA |

| DME Development Limited | 0.43% | CRISIL AAA |

| DME Development Limited | 0.43% | CRISIL AAA |

| DME Development Limited | 0.43% | CARE AAA |

| DME Development Limited | 0.43% | CRISIL AAA |

| DME Development Limited | 0.43% | CRISIL AAA |

| DME Development Limited | 0.43% | CRISIL AAA |

| DME Development Limited | 0.43% | CRISIL AAA |

| DME Development Limited | 0.42% | CRISIL AAA |

| DME Development Limited | 0.42% | CRISIL AAA |

| Cash Management Bills | 1.67% | |

| Government of India | 0.85% | SOV |

| Government of India | 0.82% | SOV |

| Transport Infrastructure | 0.65% | |

| IRB InvIT Fund | 0.65% | |

| Money Market Instruments | 0.37% | |

| Sharekhan Ltd | 0.37% | ICRA A1+ |

| Alternative Investment Funds (AIF) | 0.31% | |

| Corporate Debt Market Development Fund | 0.31% | |

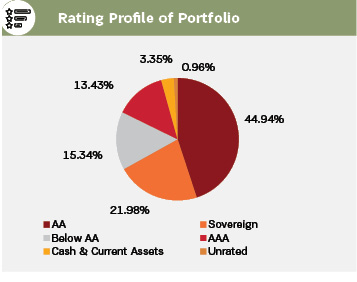

| Cash & Current Assets | 3.35% | |

| Total Net Assets | 100.00% |

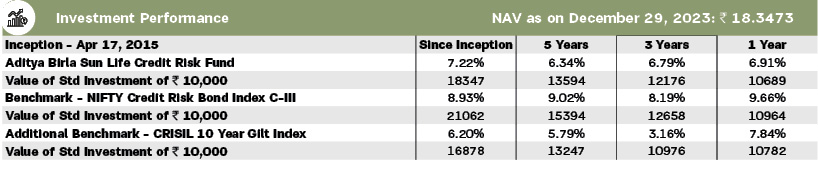

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 2. Total Schemes managed by Mr. Mohit Sharma is 22. Total Schemes managed by Ms. Sunaina Da Cunha is 5. Total Schemes managed by Mr. Dhaval Joshi is 51. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.