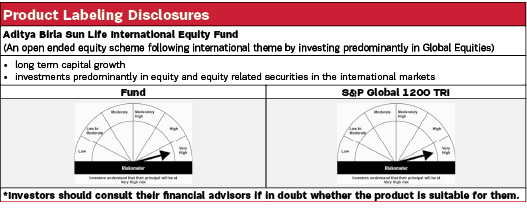

Aditya Birla Sun Life International Equity Fund |

|

| An open ended equity scheme following international theme by investing predominantly in Global Equities. |

| Data as on 29th December 2023 |

|

Fund Details |

|

Investment Objective |

|

| An Open-ended diversified equity scheme with an objective to generate long-term growth of capital, by investing predominantly in a diversified portfolio of equity and equity related securities in the international markets. | |

|

| Fund Manager | |

|---|---|

| Mr. Dhaval Joshi |

| Managing Fund Since | |

|---|---|

| November 21, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 1.1 years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | For redemption/switch-out of units on or before 30 days from the date of allotment: 1% of applicable NAV. For redemption /switch-out of units after 30 days from the date of allotment: Nil. |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 2.53% |

| Direct | 1.95% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 200.94 Crores |

| AUM as on last day | 204.35 Crores |

| Date of Allotment | |

|---|---|

| October 31, 2007 |

| Benchmark | |

|---|---|

| S&P Global 1200 TRI |

| Other Parameters | |

|---|---|

| Portfolio Turnover | 0.75 |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 1,000/- |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 32.2773 | 34.5134 |

| IDCW$: | 16.9104 | 34.5339 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

| United States of America | 62.78% |

| State Street Corp | 2.17% |

| EMERSON ELECTRIC CO | 2.10% |

| Ecolab Inc | 2.10% |

| Agilent Technologies Inc | 2.09% |

| The Bank of New York Mellon Corporation | 2.08% |

| Wells Fargo & Co | 2.06% |

| Polaris Inc | 2.04% |

| Comcast Corp | 2.02% |

| Equifax Inc | 2.01% |

| Allegion PLC | 2.01% |

| Taiwan Semiconductor Manufacturing Co Ltd | 1.99% |

| Teradyne Inc | 1.99% |

| Blackrock Inc | 1.98% |

| CONSTELLATION BRANDS INC-A | 1.97% |

| Zimmer Biomet Holdings Inc | 1.93% |

| MarketAxess Holdings Inc | 1.91% |

| Yum China Holdings Inc | 1.86% |

| GILEAD SCIENCES INC | 1.85% |

| NIKE Inc | 1.81% |

| Ambev SA | 1.79% |

| GUIDEWIRE SOFTWARE INC | 1.33% |

| Masco Corp | 1.20% |

| Tyler Technologies Inc | 1.19% |

| INTERCONTINENTAL EXCHANGE INC | 1.15% |

| Tradeweb Markets Inc | 1.15% |

| Alphabet Inc A | 1.13% |

| ROPER TECHNOLOGIES INC | 1.11% |

| Medtronic PLC | 1.04% |

| Harley-Davidson Inc | 1.02% |

| VEEVA SYSTEMS INC | 1.02% |

| Berkshire Hathaway Inc | 1.02% |

| Rockwell Automation Inc | 1.01% |

| Kellogg Co | 0.96% |

| Microchip Technology Inc | 0.95% |

| Biogen Inc | 0.95% |

| Raytheon Technologies Corp | 0.92% |

| PHILIP MORRIS INTERNATIONAL INC | 0.92% |

| Fortinet Inc | 0.90% |

| Corteva Inc | 0.88% |

| Alibaba Group Holding Ltd | 0.85% |

| The Walt Disney Company | 0.84% |

| Issuer | % to Net Assets |

| Etsy Inc | 0.76% |

| Baidu Inc | 0.73% |

| United Kingdom | 8.95% |

| LONDON STOCK EXCHANGE GROUP | 2.16% |

| EXPERIAN PLC | 2.06% |

| Imperial Brands | 1.96% |

| GSK PLC | 0.95% |

| UNILEVER PLC | 0.92% |

| British American Tobacco PLC | 0.90% |

| France | 6.30% |

| Sanofi | 2.14% |

| SAFRAN SA | 2.08% |

| Airbus SE | 2.08% |

| Sweden | 3.94% |

| Assa Abloy AB | 2.16% |

| Elekta AB | 1.78% |

| Australia | 2.14% |

| Australia & New Zealand Banking Group Limited | 1.12% |

| Westpac Banking Corp | 1.03% |

| Germany | 2.03% |

| GEA GROUP AG | 1.03% |

| Bayer AG | 1.00% |

| Belgium | 1.97% |

| Anheuser-Busch InBev SA/NV | 1.97% |

| Singapore | 1.95% |

| Singapore Exchange Ltd | 1.95% |

| Japan | 1.87% |

| Daifuku Co Ltd | 1.00% |

| Nabtesco Corp | 0.87% |

| FRANCE | 1.84% |

| ASMLHOLDING NV | 1.84% |

| HongKong | 1.73% |

| Tencent Holdings | 1.73% |

| Switzerland | 1.64% |

| Roche Holdings Ag Genus Bearer Shs | 0.95% |

| Barry Callebaut AG | 0.69% |

| Denmark | 0.99% |

| Chr Hansen Holding A/S | 0.99% |

| Canada | 0.93% |

| BRP INC | 0.93% |

| Cash & Current Assets | 0.95% |

| Total Net Assets | 100.00% |

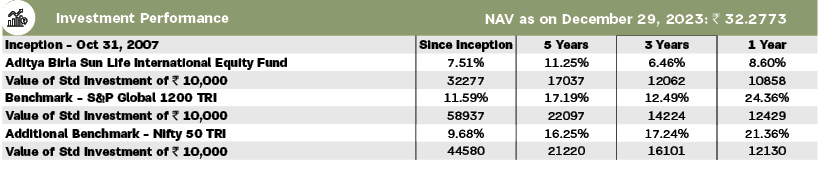

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes managed by Mr. Dhaval Joshi is 51. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

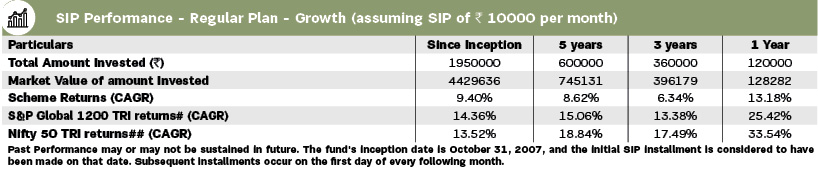

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past

performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration.