Aditya Birla Sun Life Liquid Fund |

|

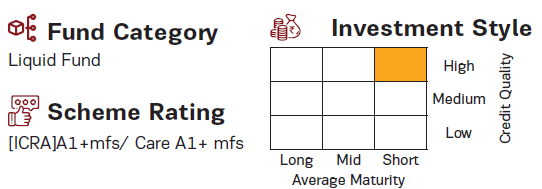

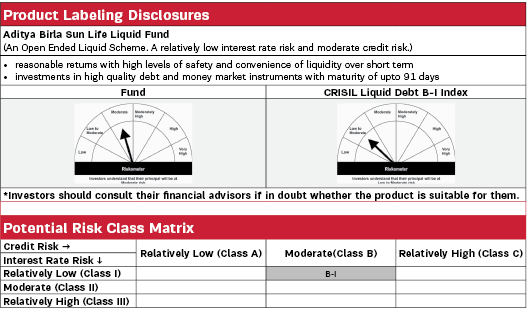

| An Open Ended Liquid Scheme. A relatively low interest rate risk and moderate credit risk. |

| Data as on 31st December 2023 |

Aditya Birla Sun Life Liquid Fund |

|

| An Open Ended Liquid Scheme. A relatively low interest rate risk and moderate credit risk. |

| Data as on 31st December 2023 |

|

Fund Details |

|

Investment Objective |

|

| The objective of the scheme is to provide reasonable returns at a high level of safety and liquidity through Investment Objective judicious investments in high quality debt and money market instruments. | |

|

| Fund Manager | |

|---|---|

| Mr. Kaustubh Gupta, Ms. Sunaina Da Cunha, Mr. Sanjay Pawar & Mr. Dhaval Joshi |

| Managing Fund Since | |

|---|---|

| July 15, 2011, July 15, 2011, July 01, 2022 & November 21, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 12.5 years, 12.5 years, 1.5 Years & 1.1 Years |

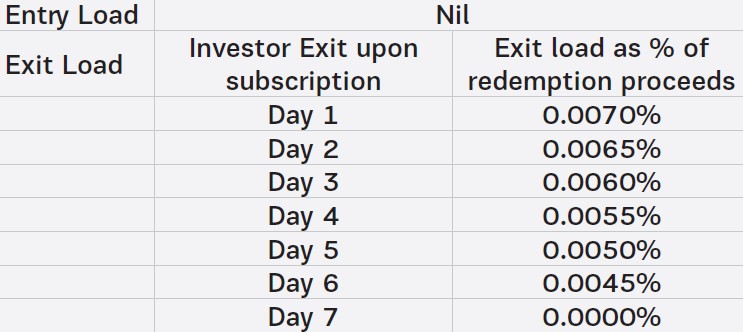

| Load Structure (as % of NAV) (Incl. for SIP) |

|---|

|

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.34% |

| Direct | 0.21% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 38766.02 Crores |

| AUM as on last day^ | 33849.81 Crores |

| ^Net assets excludes aggregate investments by other schemes of Aditya Birla Sun Life Mutual Fund amounting to Rs. 202.06 Crs as on December 29, 2023. | |

| Date of Allotment | |

|---|---|

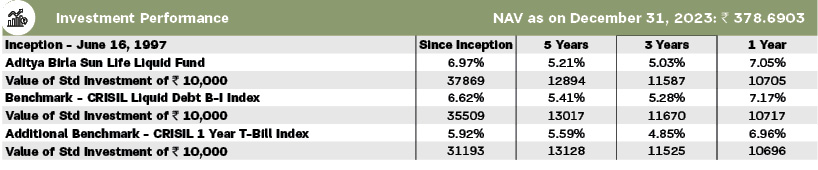

| June 16, 1997 |

| Benchmark | |

|---|---|

| CRISIL Liquid Debt B-I Index |

| Other Parameters | |

|---|---|

| Modified Duration | 0.16 years |

| Average Maturity | 0.16 years |

| Yield to Maturity | 7.55% |

| Macaulay Duration | 0.16 years |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 500) |

| Min. Addl. Investment | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 500) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 500/- |

|

|

||||

|---|---|---|---|---|

| Regular Plan | Retail Plan@ | Institutional Plan | Direct Plan | |

| Growth | 378.6903 | 614.5346 | 630.6397 | 382.5144 |

| IDCW$: | 100.1950 | - | - | 100.1950 |

| Weekly IDCW$: | 100.2702 | - | 108.2684 | 100.2648 |

| Daily IDCW$: | 158.4543 | 163.6940 | 108.0230 | 207.6751 |

| $Income Distribution cum capital withdrawal ^The Face Value per unit of all the plans/ options under Aditya Birla Sun Life Liquid Fund is ₹ 100/- @Retail Plan and Institutional Plan has been discontinued and does not accept fresh subscriptions/Switch in. |

||||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

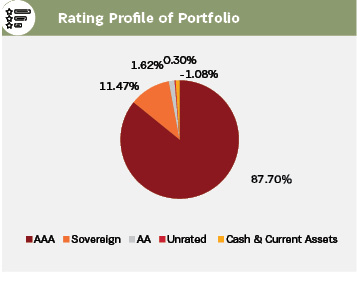

| Money Market Instruments | 85.66% | |

| Bank of Baroda | 3.57% | IND A1+ |

| Bank of Baroda | 3.32% | IND A1+ |

| Punjab & Sind Bank | 2.93% | ICRA A1+ |

| Bank of Baroda | 2.89% | IND A1+ |

| Bank of Maharashtra | 2.17% | CRISIL A1+ |

| Punjab National Bank | 1.98% | ICRA A1+ |

| HDFC Bank Limited | 1.85% | IND A1+ |

| L&T Metro Rail Hyderabad Ltd | 1.60% | CRISIL A1+ |

| HDFC Bank Limited | 1.47% | CARE A1+ |

| PNB Housing Finance Limited | 1.45% | CRISIL A1+ |

| Union Bank of India | 1.45% | IND A1+ |

| Tata Steel Limited | 1.45% | ICRA A1+ |

| TVS Credit Services Limited | 1.45% | ICRA A1+ |

| National Bank For Agriculture and Rural Development | 1.45% | ICRA A1+ |

| The Jammu & Kashmir Bank Limited | 1.45% | CRISIL A1+ |

| National Bank For Agriculture and Rural Development | 1.45% | ICRA A1+ |

| LIC Housing Finance Limited | 1.43% | ICRA A1+ |

| Bank of Baroda | 1.38% | IND A1+ |

| Punjab National Bank | 1.30% | ICRA A1+ |

| Cholamandalam Investment and Finance Company Limited | 1.17% | ICRA A1+ |

| L&T Metro Rail Hyderabad Ltd | 1.16% | CRISIL A1+ |

| Bharti Telecom Limited | 1.16% | CRISIL A1+ |

| L&T Metro Rail Hyderabad Ltd | 1.16% | CRISIL A1+ |

| HDFC Bank Limited | 1.10% | CARE A1+ |

| Canara Bank | 1.02% | CRISIL A1+ |

| Can Fin Homes Limited | 1.02% | ICRA A1+ |

| HDFC Bank Limited | 1.01% | ICRA A1+ |

| Canara Bank | 0.96% | CRISIL A1+ |

| Panatone Finvest Limited | 0.95% | CRISIL A1+ |

| Canara Bank | 0.94% | CRISIL A1+ |

| SBICAP Securities Limited | 0.88% | ICRA A1+ |

| HDFC Credila Financial Services Pvt Limited | 0.87% | ICRA A1+ |

| Union Bank of India | 0.81% | IND A1+ |

| Bharti Telecom Limited | 0.80% | CRISIL A1+ |

| Birla Group Holdings Private Limited | 0.80% | ICRA A1+ |

| Larsen & Toubro Limited | 0.80% | CRISIL A1+ |

| DBS Bank Ltd/India | 0.73% | IND A1+ |

| Canara Bank | 0.73% | CRISIL A1+ |

| National Bank For Agriculture and Rural Development | 0.73% | ICRA A1+ |

| Reliance Retail Ventures Limited | 0.73% | CRISIL A1+ |

| Jamnagar Utilities & Power Private Limited | 0.73% | CRISIL A1+ |

| Tata Steel Limited | 0.73% | ICRA A1+ |

| Union Bank of India | 0.73% | IND A1+ |

| RBL Bank Limited | 0.73% | ICRA A1+ |

| Shriram Finance Ltd | 0.73% | CRISIL A1+ |

| ICICI Securities Limited | 0.72% | ICRA A1+ |

| The Jammu & Kashmir Bank Limited | 0.72% | CRISIL A1+ |

| National Bank For Agriculture and Rural Development | 0.67% | ICRA A1+ |

| TATA Realty & Infrastructure Limited | 0.60% | ICRA A1+ |

| Bajaj Finance Limited | 0.59% | ICRA A1+ |

| Axis Securities Limited | 0.59% | ICRA A1+ |

| Tata Capital Financial Services Limited | 0.59% | ICRA A1+ |

| Hinduja Leyland Finance Limited | 0.58% | CRISIL A1+ |

| Tata Housing Development Company Limited | 0.58% | CARE A1+ |

| IndusInd Bank Limited | 0.58% | CRISIL A1+ |

| Reliance Industries Limited | 0.58% | CRISIL A1+ |

| Punjab National Bank | 0.58% | ICRA A1+ |

| Julius Baer Capital India Private Limited | 0.58% | ICRA A1+ |

| L&T Metro Rail Hyderabad Ltd | 0.58% | CRISIL A1+ |

| SBICAP Securities Limited | 0.58% | ICRA A1+ |

| IDFC First Bank Limited | 0.52% | CRISIL A1+ |

| HDFC Bank Limited | 0.51% | CARE A1+ |

| Motilal Oswal Financial Services Limited | 0.44% | ICRA A1+ |

| National Bank For Agriculture and Rural Development | 0.44% | CRISIL A1+ |

| Bank of Baroda | 0.44% | IND A1+ |

| Barclays Invest & Loans India Limited | 0.44% | ICRA A1+ |

| Canara Bank | 0.44% | CRISIL A1+ |

| Julius Baer Capital India Private Limited | 0.43% | ICRA A1+ |

| Canara Bank | 0.43% | CRISIL A1+ |

| The Jammu & Kashmir Bank Limited | 0.43% | CRISIL A1+ |

| HDFC Securities Limited | 0.43% | ICRA A1+ |

| Axis Securities Limited | 0.43% | ICRA A1+ |

| Motilal Oswal Finvest Limited | 0.43% | CRISIL A1+ |

| Godrej Properties Limited | 0.38% | ICRA A1+ |

| L&T Metro Rail Hyderabad Ltd | 0.36% | CRISIL A1+ |

| Godrej Properties Limited | 0.36% | ICRA A1+ |

| Issuer | % to Net Assets |

Rating |

| Piramal Capital & Housing Finance Limited | 0.29% | CARE A1+ |

| Piramal Capital & Housing Finance Limited | 0.29% | CARE A1+ |

| Tata Housing Development Company Limited | 0.29% | CARE A1+ |

| LIC Housing Finance Limited | 0.29% | ICRA A1+ |

| Canara Bank | 0.29% | CRISIL A1+ |

| Hinduja Leyland Finance Limited | 0.29% | CRISIL A1+ |

| GIC Housing Finance Limited | 0.29% | ICRA A1+ |

| Barclays Invest & Loans India Limited | 0.29% | ICRA A1+ |

| Sikka Ports and Terminals Limited | 0.29% | CRISIL A1+ |

| Cholamandalam Investment and Finance Company Limited | 0.29% | ICRA A1+ |

| Piramal Capital & Housing Finance Limited | 0.29% | CARE A1+ |

| Infina Finance Private Limited | 0.29% | ICRA A1+ |

| Piramal Capital & Housing Finance Limited | 0.29% | CARE A1+ |

| Hinduja Leyland Finance Limited | 0.29% | CRISIL A1+ |

| BOB Financial Solutions Limited | 0.29% | CRISIL A1+ |

| Nuvoco Vistas Corp Limited | 0.29% | CRISIL A1+ |

| HDFC Bank Limited | 0.29% | ICRA A1+ |

| National Bank For Agriculture and Rural Development | 0.22% | ICRA A1+ |

| Godrej Industries Limited | 0.22% | ICRA A1+ |

| Godrej Industries Limited | 0.22% | ICRA A1+ |

| Godrej Industries Limited | 0.22% | ICRA A1+ |

| Tata Housing Development Company Limited | 0.22% | CARE A1+ |

| Godrej Industries Limited | 0.22% | ICRA A1+ |

| Godrej Industries Limited | 0.22% | ICRA A1+ |

| JM Financial Services Ltd | 0.22% | ICRA A1+ |

| IndusInd Bank Limited | 0.22% | CRISIL A1+ |

| Godrej Properties Limited | 0.22% | ICRA A1+ |

| Sikka Ports and Terminals Limited | 0.22% | CRISIL A1+ |

| National Bank For Agriculture and Rural Development | 0.22% | ICRA A1+ |

| BOB Financial Solutions Limited | 0.22% | CRISIL A1+ |

| JM Financial Services Ltd | 0.22% | ICRA A1+ |

| Godrej Properties Limited | 0.16% | ICRA A1+ |

| Sundaram Finance Limited | 0.15% | ICRA A1+ |

| Barclays Invest & Loans India Limited | 0.15% | ICRA A1+ |

| Union Bank of India | 0.15% | IND A1+ |

| Small Industries Development Bank of India | 0.15% | CARE A1+ |

| Punjab National Bank | 0.15% | CARE A1+ |

| Blue Star Limited | 0.15% | CRISIL A1+ |

| Canara Bank | 0.15% | CRISIL A1+ |

| Axis Bank Limited | 0.15% | ICRA A1+ |

| Godrej Properties Limited | 0.15% | ICRA A1+ |

| Canara Bank | 0.14% | CRISIL A1+ |

| Hinduja Leyland Finance Limited | 0.14% | CRISIL A1+ |

| Indian Bank | 0.13% | CRISIL A1+ |

| Godrej Properties Limited | 0.08% | ICRA A1+ |

| National Bank For Agriculture and Rural Development | 0.07% | ICRA A1+ |

| Creamline Dairy Products Ltd | 0.07% | CRISIL A1+ |

| Standard Chartered Securities India Ltd | 0.07% | ICRA A1+ |

| Punjab National Bank | 0.04% | ICRA A1+ |

| ICICI Securities Limited | 0.04% | ICRA A1+ |

| Canara Bank | 0.04% | CRISIL A1+ |

| Axis Bank Limited | 0.04% | ICRA A1+ |

| National Bank For Agriculture and Rural Development | 0.04% | ICRA A1+ |

| Redington (India) Limited | 0.02% | ICRA A1+ |

| ICICI Securities Limited | 0.01% | ICRA A1+ |

| TREASURY BILLS | 11.08% | |

| Government of India | 7.25% | SOV |

| Government of India | 1.78% | SOV |

| Government of India | 1.47% | SOV |

| Government of India | 0.58% | SOV |

| Fixed rates bonds - Corporate | 3.65% | |

| Bharti Hexacom Limited | 1.17% | CRISIL AA+ |

| National Bank For Agriculture and Rural Development | 1.17% | ICRA AAA |

| Embassy Office Parks REIT | 0.53% | CRISIL AAA |

| Muthoot Finance Limited | 0.44% | ICRA AA+ |

| National Bank For Agriculture and Rural Development | 0.31% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 0.03% | ICRA AAA |

| State Government bond | 0.32% | |

| MAHARASHTRA 09.35% 30JAN24 SDL | 0.16% | SOV |

| 7.97% ODISHA 17JAN2024 SDL | 0.09% | SOV |

| 9.24% MAHARASHTRA 16JAN2024 SDL | 0.07% | SOV |

| Alternative Investment Funds (AIF) | 0.30% | |

| Corporate Debt Market Development Fund | 0.30% | |

| Government Bond | 0.07% | |

| 07.32% GS 28JAN2024 | 0.07% | SOV |

| Cash & Current Assets | -1.08% | |

| Total Net Assets | 100.00% |

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 1. Total Schemes managed by Mr. Kaustubh Gupta is 10. Total Schemes managed by Ms. Sunaina Da Cunha is 5. Total Schemes managed by Mr. Sanjay Pawar is 2. Total Schemes managed by Mr. Dhaval Joshi is 51. Click here to know more on performance of schemes managed by Fund Managers.

Other funds managed by Mr. Sanjay Pawar - Aditya Birla Sun Life CRISIL Liquid Overnight ETF

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

This page is a part of the December 2023 Factsheet of Aditya Birla Sun Life Mutual Fund. Click on http://empower.abslmf.com/ for the digital factsheet.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.