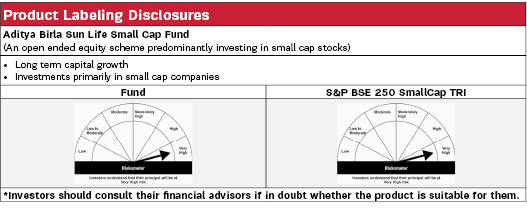

Aditya Birla Sun Life Small Cap Fund |

|

| An open ended equity scheme predominantly investing in small cap stocks. |

| Data as on 29th December 2023 |

|

Fund Details |

|

Investment Objective |

|

| The Scheme seeks to generate consistent long-term capital appreciation by investing predominantly in equity and equity related securities of Small cap companies. | |

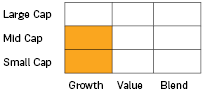

Fund Category |

Investment Style |

||

| Small cap Fund |  |

||

| Fund Manager | |

|---|---|

| Mr. Vishal Gajwani & Mr. Dhaval Joshi |

| Managing Fund Since | |

|---|---|

| October 04, 2022 & November 21, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 1.3 years & 1.1 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | For redemption /switchout of units on or before 90 days from the date of allotment: 1.00% of applicable NAV. For redemption / switch-out of units after 90 days from the date of allotment: Nil. |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 1.86% |

| Direct | 0.74% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 5160.11 Crores |

| AUM as on last day | 5251.11 Crores |

| Date of Allotment | |

|---|---|

| May 31, 2007 |

| Benchmark | |

|---|---|

| S&P BSE 250 SmallCap TRI |

| Other Parameters | |

|---|---|

| Standard Deviation | 16.54% |

| Sharpe Ratio | 1.12 |

| Beta | 0.89 |

| Portfolio Turnover | 0.37 |

| Note: Standard Deviation, Sharpe Ratio & Beta are calculated on Annualised basis using 3 years history of monthly returns. Risk Free Rate assumed to be 6.90% (FBIL Overnight MIBOR as on 29 December 2023) for calculating Sharpe Ratio | |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 1,000/- |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 72.4593 | 81.0128 |

| IDCW$: | 34.2506 | 64.9455 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

| Industrial Products | 8.53% |

| Prince Pipes & Fittings Limited | 1.98% |

| RHI Magnesita India Limited | 1.80% |

| RR Kabel Ltd | 1.56% |

| Kirloskar Pneumatic Co Ltd | 1.11% |

| Carborundum Universal Limited | 0.78% |

| IFGL Refractories Limited | 0.76% |

| INOX India Ltd | 0.54% |

| Auto Components | 7.20% |

| Craftsman Automation Ltd | 1.30% |

| Rolex Rings Limited | 1.11% |

| Sona BLW Precision Forgings Limited | 1.03% |

| SJS Enterprises Pvt Limited | 1.01% |

| Sundram Fasteners Limited | 0.91% |

| Minda Corporation Limited | 0.72% |

| Endurance Technologies Limited | 0.69% |

| CEAT Limited | 0.38% |

| Steel Strips Wheels Ltd | 0.04% |

| Consumer Durables | 6.92% |

| Campus Activewear Limited | 1.31% |

| VIP Industries Limited | 1.19% |

| Kajaria Ceramics Limited | 1.01% |

| Stylam Industries Ltd | 0.94% |

| Orient Electric Ltd. | 0.91% |

| SHEELA FOAM LIMITED | 0.88% |

| Butterfly Gandhimathi Appliances Ltd | 0.37% |

| Havells India Limited | 0.32% |

| IT - Software | 6.18% |

| Birlasoft Limited | 1.85% |

| Rategain Travel Technologies Limited | 1.48% |

| Sonata Software Limited | 1.16% |

| Tanla Platforms Limited | 0.87% |

| Coforge Limited | 0.83% |

| Finance | 5.85% |

| Cholamandalam Financial Holdings Limited | 2.12% |

| Fusion Micro Finance Ltd | 1.03% |

| Repco Home Finance Limited | 0.82% |

| Ujjivan Financial Services Limited | 0.79% |

| Home First Finance Company India Limited | 0.75% |

| IDFC Limited | 0.32% |

| Electrical Equipment | 4.90% |

| Hitachi Energy India Limited | 2.24% |

| TD Power Systems Limited | 1.75% |

| TRIVENI TURBINE LTD | 0.92% |

| Realty | 4.48% |

| Brigade Enterprises Limited | 1.75% |

| Sobha Limited | 1.28% |

| Sunteck Realty Limited | 1.00% |

| KEYSTONE REALTORS LIMITED | 0.45% |

| Pharmaceuticals & Biotechnology | 3.56% |

| Sanofi India Limited | 2.22% |

| ALEMBIC PHARMACEUTICALS LIMITED | 0.75% |

| Eris Lifesciences Limited | 0.59% |

| Commercial Services & Supplies | 3.50% |

| TeamLease Services Limited | 2.37% |

| CMS Info Systems Limited | 1.13% |

| BANKS | 3.37% |

| Axis Bank Limited | 1.46% |

| RBL Bank Limited | 1.00% |

| The Federal Bank Limited | 0.91% |

| Cement & Cement Products | 3.14% |

| JK Cement Limited | 2.50% |

| Orient Cement Limited | 0.64% |

| Textiles & Apparels | 2.92% |

| Gokaldas Exports Ltd | 1.50% |

| Welspun India Limited | 0.86% |

| K.P.R. Mill Limited | 0.56% |

| Retailing | 2.78% |

| Go Fashion India Limited | 2.19% |

| Sai Silks Kalamandir Ltd | 0.60% |

| Industrial Manufacturing | 2.75% |

| Tega Industries Limited | 1.88% |

| Issuer | % to Net Assets |

| GMM Pfaudler Limited | 0.53% |

| Cyient DLM Ltd | 0.34% |

| Capital Markets | 2.60% |

| ICICI Securities Limited | 1.78% |

| Anand Rathi Wealth Limited | 0.45% |

| Central Depository Services (India) Limited | 0.36% |

| Construction | 2.57% |

| PNC Infratech Limited | 1.00% |

| Kalpataru Projects International Ltd. | 0.91% |

| Power Mech Projects Limited | 0.66% |

| Healthcare Services | 2.45% |

| Krishna Institute of Medical Sciences Ltd | 0.98% |

| Fortis Healthcare Limited | 0.89% |

| Rainbow Childrens Medicare Limited | 0.58% |

| Agricultural Food & other Products | 2.07% |

| CCL Products (India) Limited | 1.69% |

| Balrampur Chini Mills Limited | 0.39% |

| Leisure Services | 1.82% |

| Sapphire Foods India Ltd | 0.93% |

| Chalet Hotels Limited | 0.46% |

| Restaurant Brands Asia Limited | 0.42% |

| IT - Services | 1.80% |

| Cyient Limited | 1.26% |

| eMUDHRA LTD | 0.54% |

| Chemicals & Petrochemicals | 1.67% |

| Navin Fluorine International Limited | 1.03% |

| Clean Science & Technology Limited | 0.36% |

| AETHER INDUSTRIES LTD | 0.28% |

| Banks | 1.57% |

| Bank of India | 0.97% |

| City Union Bank Limited | 0.33% |

| Indian Bank | 0.27% |

| Food Products | 1.55% |

| Bikaji Foods International Ltd | 1.14% |

| Avanti Feeds Limited | 0.41% |

| Insurance | 1.49% |

| Star Health & Allied Insurance Limited | 1.49% |

| Agricultural Commercial & Construction Vehicles | 1.34% |

| BEML Limited | 1.34% |

| Transport Services | 1.17% |

| Gateway Distriparks Limited | 0.68% |

| Container Corporation of India Limited | 0.49% |

| Personal Products | 1.15% |

| Emami Limited | 0.80% |

| Honasa Consumer Ltd | 0.35% |

| FINANCE | 1.14% |

| LIC Housing Finance Limited | 1.14% |

| Beverages | 1.01% |

| Radico Khaitan Limited | 1.01% |

| Entertainment | 0.87% |

| PVR Limited | 0.87% |

| Paper Forest & Jute Products | 0.81% |

| Century Textiles & Industries Limited | 0.81% |

| IT - Hardware | 0.69% |

| Netweb Technologies | 0.69% |

| Aerospace & Defense | 0.42% |

| MTAR Technologies Limited | 0.39% |

| ideaForge Technology Ltd | 0.03% |

| Automobiles | 0.34% |

| Landmark Cars Ltd | 0.34% |

| Financial Technology (Fintech) | 0.34% |

| PB Fintech Limited | 0.34% |

| Healthcare Equipment & Supplies | 0.25% |

| Tarsons Products Limited | 0.25% |

| Household Products | 0.21% |

| Flair Writing Industries Ltd | 0.17% |

| DOMS Industries Limited | 0.04% |

| Gas | 0.16% |

| IRM Energy Ltd | 0.16% |

| Cash & Current Assets | 4.47% |

| Total Net Assets | 100.00% |

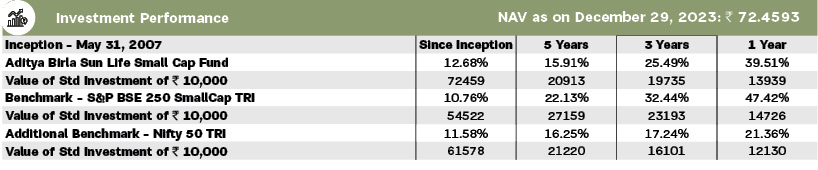

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 1. Total Schemes managed by Mr. Vishal Gajwani is 3. Total Schemes managed by Mr. Dhaval Joshi is 51. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

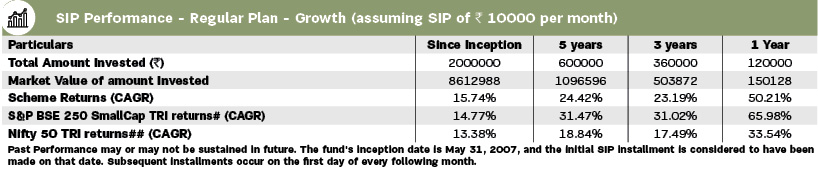

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past

performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration.