| Portfolio Holdings |

| Issuer |

% to net Assets |

Rating |

| Fixed rates bonds - Corporate |

67.22% |

|

| Century Textiles & Industries Limited |

4.87% |

CRISIL AA |

| Tata Projects Limited |

4.80% |

IND AA |

| TATA Realty & Infrastructure Limited |

4.06% |

ICRA AA+ |

| Steel Authority of India Limited |

2.97% |

CARE AA |

| GIC Housing Finance Limited |

2.94% |

ICRA AA |

| Tata Power Company Limited |

2.94% |

CARE AA |

| JSW Steel Limited |

2.93% |

ICRA AA |

| Nuvoco Vistas Corp Limited |

2.74% |

CRISIL AA |

| Avanse Financial Services Ltd |

2.47% |

CARE AA- |

| Godrej Industries Limited |

2.45% |

ICRA AA |

| Nexus Select Trust |

2.45% |

ICRA AAA |

| Adani Transmission Limited |

2.44% |

IND AA+ |

| Yes Bank Limited |

2.41% |

ICRA A- |

| ONGC Petro Additions Limited |

2.41% |

ICRA AA |

| GR Infraprojects Limited |

2.39% |

CARE AA+ |

| ANDHRA PRADESH CAPITAL REGION DEVELOPMENT AUTHORITY |

2.20% |

CRISIL A-(CE) |

| Summit Digitel Infrastructure Private Limited |

1.97% |

CRISIL AAA |

| ONGC Petro Additions Limited |

1.96% |

ICRA AA |

| JM Financial Products Limited |

1.94% |

ICRA AA |

| COASTAL GUJARAT POWER LTD |

1.77% |

CARE AA |

| Arka Fincap Limited |

1.76% |

CRISIL AA- |

| DLF Cyber City Developers Limited |

1.53% |

CRISIL AA |

| Oxyzo Financial Services Pvt Ltd |

1.49% |

ICRA A+ |

| Godrej Properties Limited |

1.47% |

ICRA AA+ |

| Samvardhana Motherson International Limited |

1.47% |

IND AAA |

| Summit Digitel Infrastructure Private Limited |

1.42% |

CRISIL AAA |

| U.P. Power Corporation Limited |

1.30% |

BWR AA-(CE) |

| U.P. Power Corporation Limited |

1.23% |

BWR AA-(CE) |

| Tata Motors Finance Limited |

0.29% |

CRISIL AA |

| Power Finance Corporation Limited |

0.11% |

CRISIL AAA |

| REC Limited |

0.05% |

ICRA AAA |

| NTPC Limited |

0.00% |

CRISIL AAA |

| Floating rates notes - Corporate |

12.41% |

|

| JM Financial Credit Solutions Ltd |

3.65% |

ICRA AA |

| Varanasi Sangam Expressway Private Limited |

2.65% |

IND AAA |

| Vedanta Limited |

1.95% |

CRISIL AA |

| DME Development Limited |

0.42% |

CRISIL AAA |

| DME Development Limited |

0.42% |

CRISIL AAA |

| DME Development Limited |

0.42% |

CRISIL AAA |

| DME Development Limited |

0.42% |

CRISIL AAA |

| DME Development Limited |

0.42% |

CRISIL AAA |

| DME Development Limited |

0.42% |

CARE AAA |

| DME Development Limited |

0.42% |

CRISIL AAA |

| DME Development Limited |

0.41% |

CRISIL AAA |

| DME Development Limited |

0.41% |

CRISIL AAA |

| DME Development Limited |

0.41% |

CRISIL AAA |

| Government Bond |

6.30% |

|

| 7.38% GOI 20JUN2027 |

1.98% |

SOV |

| 7.26% GOVERNMENT OF INDIA 06FEB33 |

1.98% |

SOV |

| 7.26% GOI 22AUG2032 |

0.99% |

SOV |

| 7.10% GOVERNMENT OF INDIA 18APR29 |

0.98% |

SOV |

| 5.22% GOVERNMENT OF INDIA 15JUN25 G-SEC |

0.38% |

SOV |

| Cash Management Bills |

3.02% |

|

| Government of India |

1.45% |

SOV |

| Government of India |

0.80% |

SOV |

| Government of India |

0.77% |

SOV |

| Transport Infrastructure |

0.65% |

|

| IRB InvIT Fund |

0.65% |

|

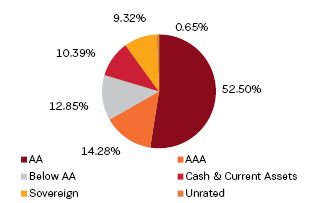

| Cash & Current Assets |

10.39% |

|

| Total Net Assets |

100.00% |

|