| Portfolio Holdings |

| Issuer |

% to net Assets |

Rating |

| Government Bond |

41.27% |

|

| 7.27% GOI 08APR26 |

18.39% |

SOV |

| 7.38% GOI 20JUN2027 |

8.32% |

SOV |

| 7.26% GOVERNMENT OF INDIA 06FEB33 |

8.32% |

SOV |

| 6.57% GOI (MD 05/12/2033) |

3.50% |

SOV |

| 7.17% GOVERNMENT OF INDIA 18APR30 |

2.75% |

SOV |

| Fixed rates bonds - Corporate |

7.56% |

|

| Housing Development Finance Corporation Limited |

7.56% |

CRISIL AAA |

| Banks |

7.53% |

|

| HDFC Bank Limited |

2.33% |

|

| ICICI Bank Limited |

2.16% |

|

| State Bank of India |

0.93% |

|

| IndusInd Bank Limited |

0.75% |

|

| Axis Bank Limited |

0.55% |

|

| RBL Bank Limited |

0.42% |

|

| Bank of Baroda |

0.38% |

|

| Money Market Instruments |

6.88% |

|

| Axis Bank Limited |

6.88% |

ICRA A1+ |

| State Government bond |

5.58% |

|

| TAMIL NADU 08.21% 24JUN25 SDL |

5.58% |

SOV |

| Finance |

2.61% |

|

| Housing Development Finance Corporation Limited |

1.65% |

|

| SBI Cards & Payment Services Limited |

0.54% |

|

| Poonawalla Fincorp Limited |

0.42% |

|

| Pharmaceuticals & Biotechnology |

1.88% |

|

| Sun Pharmaceutical Industries Limited |

0.74% |

|

| Mankind Pharma Ltd |

0.71% |

|

| Strides Pharma Science Limited |

0.43% |

|

| Consumer Durables |

1.43% |

|

| V-Guard Industries Limited |

0.59% |

|

| Crompton Greaves Consumer Electricals Limited |

0.55% |

|

| Dixon Technologies (India) Limited |

0.29% |

|

| IT - Software |

1.42% |

|

| Infosys Limited |

1.42% |

|

| Diversified FMCG |

1.14% |

|

| Hindustan Unilever Limited |

0.72% |

|

| ITC Limited |

0.42% |

|

| Construction |

0.98% |

|

| Larsen & Toubro Limited |

0.98% |

|

| Telecom - Services |

0.96% |

|

| Bharti Airtel Limited |

0.96% |

|

| Industrial Products |

0.95% |

|

| POLYCAB INDIA Limited |

0.70% |

|

| TIMKEN INDIA LTD |

0.25% |

|

| Cash Management Bills |

0.92% |

|

| Government of India |

0.92% |

SOV |

| Cement & Cement Products |

0.75% |

|

| UltraTech Cement Limited |

0.75% |

|

| Healthcare Services |

0.65% |

|

| Fortis Healthcare Limited |

0.65% |

|

| Insurance |

0.64% |

|

| HDFC Life Insurance Company Limited |

0.64% |

|

| Automobiles |

0.59% |

|

| Tata Motors Limited |

0.59% |

|

| Agricultural Commercial & Construction Vehicles |

0.58% |

|

| Ashok Leyland Limited |

0.58% |

|

| Auto Components |

0.58% |

|

| Craftsman Automation Ltd |

0.58% |

|

| Beverages |

0.51% |

|

| United Breweries Limited |

0.51% |

|

| Industrial Manufacturing |

0.50% |

|

| Honeywell Automation India Limited |

0.50% |

|

| Non - Ferrous Metals |

0.46% |

|

| Hindalco Industries Limited |

0.46% |

|

| Others |

0.42% |

|

| TD Power Systems Ltd |

0.42% |

|

| Realty |

0.36% |

|

| Brigade Enterprises Limited |

0.36% |

|

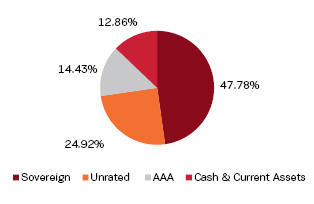

| Cash & Current Assets |

12.86% |

|

| Total Net Assets |

100.00% |

|

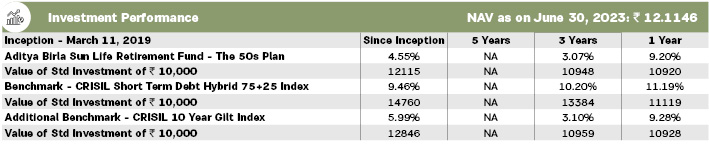

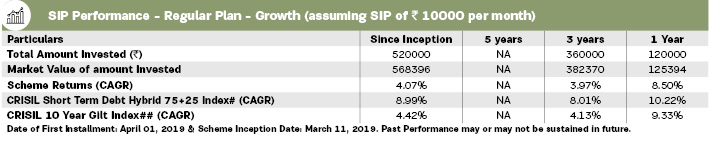

# Scheme Benchmark, ## Additional Benchmark, * As on start of period considered above.

For SIP calculations above, the data assumes the investment of

10000/- on 1st day of every month or the subsequent working day. Load & Taxes

are not considered for computation of returns. Performance for IDCW option would assume reinvestment of tax free IDCW declared at the

then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using XIRR method (investment internal rate of return).Where

Benchmark returns are not available, they have not been shown. Past performance may or may not be sustained in future. Returns greater than

1 year period are compounded annualized. IDCW are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration. For SIP

returns, monthly investment of equal amounts invested on the 1st day of every month has been considered.