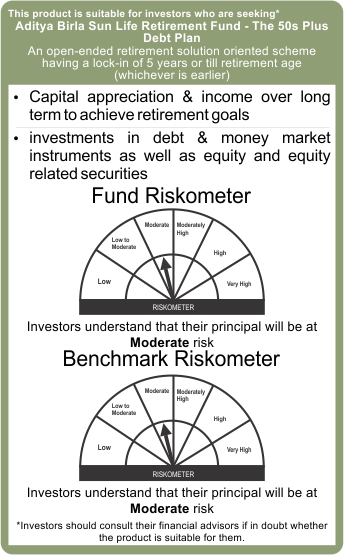

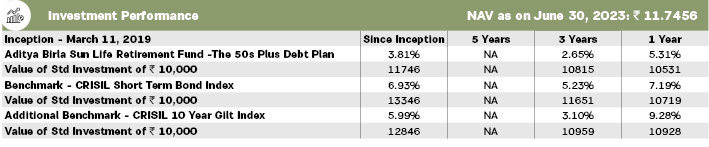

Aditya Birla Sun Life Retirement Fund - The 50s Plus Debt Plan

An open-ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier)

Fund Category Retirement Fund (Solution Oriented Fund)

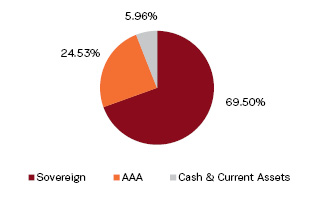

Investment Objective The primary investment objective of the Scheme is income generation and capital appreciation for its investors which will be in line with their retirement goals by investing in a mix of equity, equity related instruments along with debt and money market instruments. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes' objectives will be achieved.