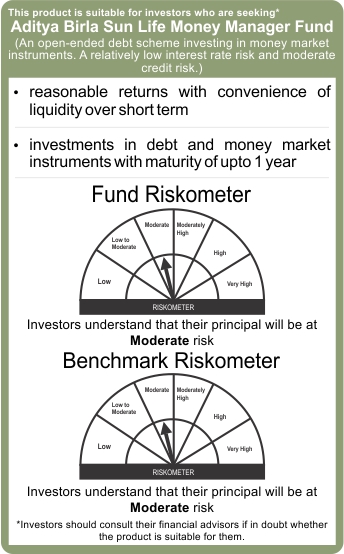

Aditya Birla Sun Life Money Manager Fund

An open-ended debt scheme investing in money market instruments. A relatively low interest rate risk and moderate credit risk.

| Fund Details | |

|---|---|

| Fund Manager: | Mr. Mohit Sharma, Mr. Kaustubh Gupta, Mr. Anuj Jain & Mr. Dhaval Joshi |

| Managing Fund Since: | April 01, 2017, July 15, 2011, March 22, 2021 & November 21, 2022 |

| Experience in Managing the Fund: | 11.9 years, 6.2 years, 2.2 years & 0.5 Years |

| Date of Allotment: | June 05, 2003 |

| Type of Scheme: | An open-ended debt scheme investing in money market instruments. A relatively low interest rate risk and moderate credit risk. |

| Application Amount for fresh subscription: | 1,000 (plus in multiplies of 1) |

| Min. Addl. Investment: | 1,000 (plus in multiplies of 1) |

| SIP: | Monthly: Minimum 1,000/- |

| NAV of Plans / Options ()^ | $Income Distribution cum capital withdrawal |

| Regular Plan | |

| Growth: | 318.9959 |

| Daily IDCW$: | 100.0727 |

| Weekly IDCW$: | 100.2116 |

| Retail Plan@ | |

| Growth: | 393.1671 |

| Daily IDCW$: | 100.0727 |

| Weekly IDCW$: | 103.8762 |

| Direct Plan | |

| Growth: | 322.3175 |

| Daily IDCW$: | 100.0727 |

| Weekly IDCW$: | 100.2140 |

| ^The Face Value per unit of all the plans/ options under

Aditya Birla Sun Life Money Manager Fund is 100/- Note:@ Retail Plan has been discontinued and does not accept fresh subscriptions/Switch in. | |

| Benchmark: | NIFTY Money Market Index B-I |

| Monthly Average AUM: | 14281.19 Crores |

| AUM as on last day^: | 13931.06 Crores |

| Load Structure (as % of NAV) (Incl. for SIP) | |

| Entry Load: | Nil |

| Exit Load: | Nil |

| Other Parameters | |

| Modified Duration: | 0.56 years |

| Average Maturity: | 0.56 years |

| Yield to Maturity: | 7.43% |

| Macaulay Duration: | 0.56 years |

| Total Expense Ratio (TER) | |

| Including additional expenses and goods and service tax on management fees. | |

| Regular | 0.33% |

| Direct | 0.21% |

Data as on 30th June 2023 unless otherwise specified

^Net assets excludes aggregate investments by other schemes of Aditya Birla Sun Life Mutual Fund amounting to Rs. 1,27,462.01 Crs

as on June 30, 2023.

| Portfolio Holdings | ||

|---|---|---|

| Issuer | % to net Assets |

Rating |

| Money Market Instruments | 85.95% | |

| Housing Development Finance Corporation Limited | 3.33% | ICRA A1+ |

| National Bank For Agriculture and Rural Development | 3.22% | ICRA A1+ |

| Small Industries Development Bank of India | 3.18% | CARE A1+ |

| HDFC Bank Limited | 3.15% | CARE A1+ |

| State Bank of India | 3.13% | CARE A1+ |

| Small Industries Development Bank of India | 3.04% | CARE A1+ |

| Indian Bank | 2.52% | CRISIL A1+ |

| Indian Bank | 2.35% | CRISIL A1+ |

| Godrej Consumer Products Limited | 2.19% | ICRA A1+ |

| The Federal Bank Limited | 1.87% | CRISIL A1+ |

| Bank of Baroda | 1.76% | IND A1+ |

| Housing Development Finance Corporation Limited | 1.70% | ICRA A1+ |

| Indian Bank | 1.57% | CRISIL A1+ |

| Bharti Enterprises Limited | 1.56% | CRISIL A1+ |

| Housing Development Finance Corporation Limited | 1.55% | ICRA A1+ |

| Axis Bank Limited | 1.53% | ICRA A1+ |

| National Bank For Agriculture and Rural Development | 1.42% | CRISIL A1+ |

| National Bank For Agriculture and Rural Development | 1.41% | ICRA A1+ |

| Export Import Bank of India | 1.41% | ICRA A1+ |

| LIC Housing Finance Limited | 1.26% | ICRA A1+ |

| Cholamandalam Investment and Finance Company Limited | 1.25% | ICRA A1+ |

| Axis Bank Limited | 1.25% | ICRA A1+ |

| Small Industries Development Bank of India | 1.23% | CARE A1+ |

| Motilal Oswal Financial Services Limited | 1.13% | ICRA A1+ |

| Bharti Enterprises Limited | 1.11% | CRISIL A1+ |

| Export Import Bank of India | 1.09% | ICRA A1+ |

| Union Bank of India | 1.03% | ICRA A1+ |

| Bahadur Chand Investments Pvt Limited | 0.97% | ICRA A1+ |

| IndusInd Bank Limited | 0.97% | CRISIL A1+ |

| Tata Teleservices Limited | 0.96% | CRISIL A1+ |

| Axis Bank Limited | 0.96% | IND A1+ |

| Small Industries Development Bank of India | 0.96% | CARE A1+ |

| Axis Bank Limited | 0.95% | IND A1+ |

| Panatone Finvest Limited | 0.95% | CRISIL A1+ |

| Indian Bank | 0.95% | CRISIL A1+ |

| Small Industries Development Bank of India | 0.94% | CRISIL A1+ |

| Bahadur Chand Investments Pvt Limited | 0.94% | ICRA A1+ |

| Small Industries Development Bank of India | 0.94% | CRISIL A1+ |

| Housing Development Finance Corporation Limited | 0.90% | ICRA A1+ |

| Housing Development Finance Corporation Limited | 0.77% | ICRA A1+ |

| Piramal Capital & Housing Finance Limited | 0.66% | CARE A1+ |

| Motilal Oswal Financial Services Limited | 0.65% | ICRA A1+ |

| Piramal Capital & Housing Finance Limited | 0.65% | CARE A1+ |

| Piramal Capital & Housing Finance Limited | 0.65% | CARE A1+ |

| Piramal Capital & Housing Finance Limited | 0.65% | CARE A1+ |

| Axis Bank Limited | 0.64% | ICRA A1+ |

| The Federal Bank Limited | 0.64% | CRISIL A1+ |

| Godrej Properties Limited | 0.64% | ICRA A1+ |

| Godrej Properties Limited | 0.64% | ICRA A1+ |

| Kotak Mahindra Bank Limited | 0.64% | CRISIL A1+ |

| Infina Finance Private Limited | 0.64% | ICRA A1+ |

| NIIF Infrastructure Finance Limited | 0.63% | ICRA A1+ |

| Kotak Mahindra Bank Limited | 0.63% | CRISIL A1+ |

| Small Industries Development Bank of India | 0.63% | CRISIL A1+ |

| Standard Chartered Capital Limited | 0.63% | ICRA A1+ |

| Housing Development Finance Corporation Limited | 0.63% | ICRA A1+ |

| Kotak Mahindra Bank Limited | 0.63% | CRISIL A1+ |

| Bahadur Chand Investments Pvt Limited | 0.63% | ICRA A1+ |

| Small Industries Development Bank of India | 0.62% | CRISIL A1+ |

| Axis Bank Limited | 0.62% | ICRA A1+ |

| Muthoot Finance Limited | 0.61% | ICRA A1+ |

| Muthoot Finance Limited | 0.55% | ICRA A1+ |

| Standard Chartered Capital Limited | 0.51% | ICRA A1+ |

| The Federal Bank Limited | 0.49% | CRISIL A1+ |

| Bharti Enterprises Limited | 0.49% | ICRA A1+ |

| JM Financial Services Ltd | 0.49% | ICRA A1+ |

| Housing Development Finance Corporation Limited | 0.48% | ICRA A1+ |

| Kotak Mahindra Bank Limited | 0.47% | CRISIL A1+ |

| Barclays Invest & Loans India Limited | 0.47% | ICRA A1+ |

| Cholamandalam Investment and Finance Company Limited | 0.46% | ICRA A1+ |

| Housing Development Finance Corporation Limited | 0.45% | ICRA A1+ |

| Tata Teleservices Maharashtra Limited | 0.38% | CRISIL A1+ |

| Motilal Oswal Finvest Limited | 0.32% | CRISIL A1+ |

| Piramal Capital & Housing Finance Limited | 0.32% | CARE A1+ |

| LIC Housing Finance Limited | 0.32% | ICRA A1+ |

| IGH Holdings Private Limited | 0.32% | CRISIL A1+ |

| Axis Bank Limited | 0.32% | ICRA A1+ |

| Axis Bank Limited | 0.32% | ICRA A1+ |

| Axis Bank Limited | 0.32% | ICRA A1+ |

| The Federal Bank Limited | 0.31% | CRISIL A1+ |

| Punjab & Sind Bank | 0.31% | ICRA A1+ |

| Birla Group Holdings Private Limited | 0.31% | ICRA A1+ |

| Sharekhan Ltd | 0.31% | ICRA A1+ |

| Deutsche Investments India Private Limited | 0.16% | ICRA A1+ |

| Motilal Oswal Finvest Limited | 0.16% | CRISIL A1+ |

| Axis Bank Limited | 0.16% | ICRA A1+ |

| The Federal Bank Limited | 0.00% | CRISIL A1+ |

| IDFC First Bank Limited | 0.00% | CRISIL A1+ |

| TREASURY BILLS | 15.74% | |

| Government of India | 2.59% | SOV |

| Government of India | 1.85% | SOV |

| Government of India | 1.80% | SOV |

| Government of India | 1.60% | SOV |

| Government of India | 1.52% | SOV |

| Government of India | 1.30% | SOV |

| Government of India | 1.26% | SOV |

| Government of India | 0.99% | SOV |

| Government of India | 0.80% | SOV |

| Government of India | 0.47% | SOV |

| Government of India | 0.39% | SOV |

| Government of India | 0.32% | SOV |

| Government of India | 0.32% | SOV |

| Government of India | 0.19% | SOV |

| Government of India | 0.16% | SOV |

| Government of India | 0.16% | SOV |

| Government of India | 0.03% | SOV |

| Government Bond | 2.14% | |

| 7.68% GOI (MD 15/12/2023) | 1.65% | SOV |

| 07.32% GS 28JAN2024 | 0.49% | SOV |

| Cash Management Bills | 0.39% | |

| Government of India | 0.36% | SOV |

| Government of India | 0.03% | SOV |

| Interest Rate Swaps | 0.00% | |

| Standard Chartered Bank | 0.00% | |

| BNP Paribas - Indian branches | 0.00% | |

| IDFC First Bank Limited | 0.00% | |

| ICICI Securities Primary Dealership Limited | 0.00% | |

| Standard Chartered Bank | 0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Standard Chartered Bank | -0.00% | |

| Standard Chartered Bank | -0.00% | |

| Standard Chartered Bank | -0.00% | |

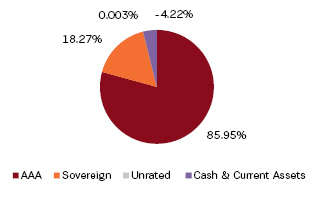

| Cash & Current Assets | -4.22% | |

| Total Net Assets | 100.00% | |

| Rating Profile of Portfolio |

|---|

|

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

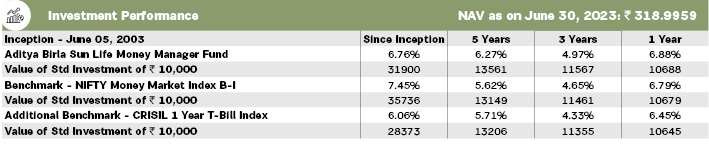

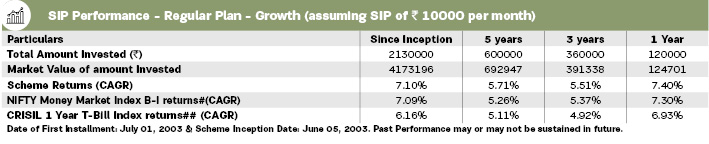

Note: # Scheme Benchmark, ## Additional Benchmark, * As on start of period considered above. For SIP calculations above, the data assumes the investment of 10000/- on 1st day of every month or the subsequent working day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown. Past performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration. For SIP returns, monthly investment of equal amounts invested on the 1st day of every month has been considered.

This page is a part of the July 2023 Factsheet of Aditya Birla Sun Life Mutual Fund. Click on http://empower.abslmf.com/ for the digital factsheet.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.