World growth has been remarkably resilient, albeit with momentum shifting from manufacturing to services sector, despite aggressive tightening of

Central banks, dislocations caused by geo-political tensions and risks in US banking sector. The concerted, global, and very aggressive monetary policy

tightening since early 2022 has begun to show its impact in interest-sensitive goods-producing industries. But the impact has been rather narrow

and the strong performance from services sector. China has been the only major economy where growth has been surprising to the downside with an

underwhelming post Covid rebound. The policy response so far has also been underwhelming with a 10 Basis points (bps) rate cut by PBoC (People’s

Bank of China). No big bang fiscal/credit stimulus has so far been announced reflecting change in government priorities from level of growth to quality/

sustainability of growth.

Headline inflation has witnessed softening contributed by softer energy and food prices, but core inflation remains elevated and sticky. Thus, Central bank could continue to be in the hawkish mode and more rate hikes are likely despite rates reaching highest levels since Global Financial Crisis.

Indian economic recovery continues to broaden despite lurking risks from external sector. PMIs(Purchasing Manager Index) continue to be very strong

at closed to decadal highs, GST collections strong, capacity utilization at elevate levels, credit growth robust, housing cycle momentum healthy, and

indicators of services sector particularly travel and tourism looking strong. Pick up in construction and informal activity in urban areas is also positive for

rural economy. Capex intentions of private companies have also shot up. Latest round of consumer confidence survey results points to continued recovery

in consumer sentiment. Moreover, we should remember that fiscal policy is far too loose for current level of growth. With monsoon recovering sharply

another risk to growth appears to have waned.

Current Account Deficit for Q4 came down sharply to $1.4 bn from $16.8 bn figure a quarter earlier ($67.1 bn for full year). The improvement was on

account of fall in trade deficit and continuing robust services exports. In % GDP terms, CAD (Current Account Deficit) posted a figure of 0.2% of GDP in

Q4 (improved from figure of 2.0% of GDP figure in Q3) (FY23 CAD at 2.0% of GDP for full year). We expect FY24 CAD at 1.25%.

Consumer Price Index (CPI) Inflation slowed down to 4.25% YoY in May (down from 4.7% YoY in April) and posted third consecutive month of sub-6 prints.

Core inflation was also down to 5.02% YoY in May (down from 5.19% YoY in April), but the momentum in core was down sequentially (from 0.59% MoM

in April to 0.30% MoM in May). Food inflation moderated to 3.29% YoY in May (down from 4.16% YoY in April), but this is much more attributable to high

base effects as momentum in food prices increased in May (0.62% MoM in May, up from 0.51% MoM in April). Going ahead we believe that inflation has

bottomed and given the sharp surge in prices of vegetables and some pulses, we expect inflation to inch upwards towards 5% (4.5% in June reading)

Indian rates have surged since the RBI June policy with 10 years rising by close to 20bps from May-lows as a section of market (we were never on early

rate cut camp) which got confident on early rate easing by RBI recalibrated their expectations given the hawkish policy tone from RBI as well as major

global Central Bankers. RBI’s focus on 4% inflation target and not been satisfied by mere return to below 6%, coupled with strong growth momentum

and risks emanating from the surge in food prices means that rate cut is unlikely in FY24. Moreover, supply of papers remains high not only from Central

Government, but even State Governments have started borrowing significantly higher than last year. Credit growth both via banks and corporate bond

market remain strong. Also, the upcoming election heavy season and the recent election outcomes and political statements from political parties suggest

that populist tendency will rise in the run up to elections, thereby keeping pressure on supply elevated, keeping a floor on bond yields. In India, the

bar for further rate hikes remains high and this should be the terminal rate for this cycle given what we know today. Rate cuts are a FY25 story absent

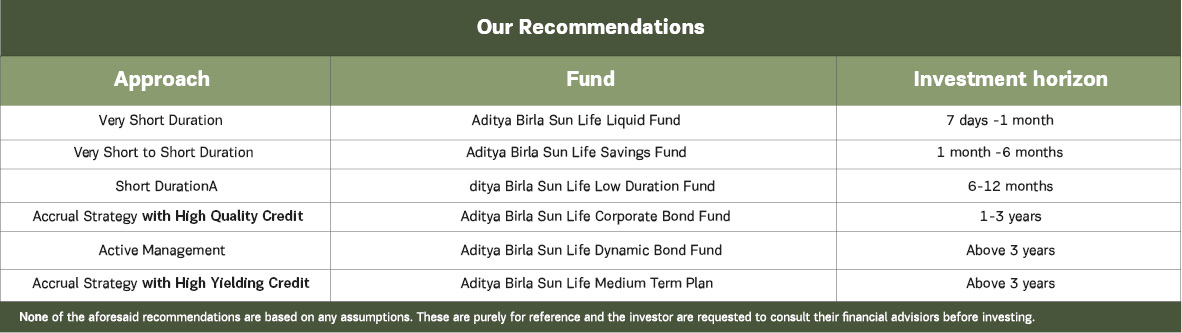

unanticipated shocks. In our baseline scenario, rate cuts if any will be shallow and linked to downside surprises on growth. Accrual remains the theme for

2023 on a risk-reward basis. The yield curve in the 2 – 5 years segment is offering attractive nominal yields; longer end can endure some pain because

of demand-supply mismatch that we foresee over there.

Entire AAA yield curve between 1-3 year is available at 7.6% - 8.0%. Most likely in 2023, actively managed funds will do well within fixed income space

as play on liquidity needs active modulation. We see limited gains in duration as policy space are constrained. Thus, short-term investors should look

to invest in money market, ultra-short-term funds & low duration funds until more clarity on growth emerges. Investors with a longer-term investment

horizon can look to invest in actively managed short-term funds & passive strategies like target maturity funds. Time to dial actively managed shortduration

funds is back on a risk reward adjusted basis.

Data as on 30th June 2023, Source: CEIC, Bloomberg, RBI

This page is a part of the July 2023 Factsheet of Aditya Birla Sun Life Mutual Fund. Click on http://empower.abslmf.com/ for the digital factsheet.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.