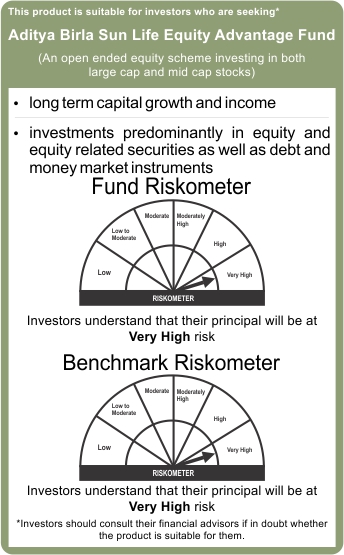

Aditya Birla Sun Life Equity Advantage Fund

An open ended equity scheme investing in both large cap and mid cap stocks

| Fund Details | |

|---|---|

| Fund Manager: | Mr. Dhaval Joshi & Mr. Atul Penkar |

| Managing Fund Since: | November 21, 2022 & February 17, 2023 |

| Experience in Managing the Fund: | 0.5 Years & 0.3 years |

| Date of Allotment: | February 24, 1995 |

| Type of Scheme: | An open ended equity scheme investing in both large cap and mid cap stocks |

| Application Amount for fresh subscription: | 1,000 (plus in multiplies of 1) |

| Min. Addl. Investment: | 1,000 (plus in multiplies of 1) |

| SIP: | Monthly: Minimum 1,000/- |

| NAV of Plans / Options () | $Income Distribution cum capital withdrawal |

| Regular Plan | |

| Growth: | 653.8400 |

| IDCW$: | 116.9100 |

| Direct Plan | |

| Growth: | 715.2900 |

| IDCW$: | 176.7300 |

| Benchmark: | Nifty Large Midcap 250 TRI |

| Monthly Average AUM: | 5102.21 Crores |

| AUM as on last day: | 5111.17 Crores |

| Load Structure (as % of NAV) (Incl. for SIP) | |

| Entry Load: | Nil |

| Exit Load: For redemption / switch-out of units on or before 90 days from the date of allotment: 1.00% of applicable NAV. For redemption / switch-out of units after 90 days from the date of allotment: Nil. | |

| Other Parameters | |

| Standard Deviation: | 15.59% |

| Sharpe Ratio: | 0.96 |

| Beta: | 0.99 | Portfolio Turnover: | 0.48 |

| Total Expense Ratio (TER) | |

| Including additional expenses and goods and service tax on management fees. | |

| Regular | 1.93% |

| Direct | 1.11% |

Note: Standard Deviation, Sharpe Ratio & Beta are calculated on

Annualised basis using 3 years history of monthly returns. Risk Free Rate assumed to be 6.9% (FBIL Overnight MIBOR as on 30 June 2023) for calculating Sharpe Ratio

Data as on 30th June 2023 unless otherwise specified

| Portfolio Holdings | ||

|---|---|---|

| Issuer | % to net Assets |

Rating |

| Banks | 20.47% | |

| ICICI Bank Limited | 6.22% | |

| HDFC Bank Limited | 4.46% | |

| Axis Bank Limited | 3.29% | |

| State Bank of India | 3.25% | |

| The Federal Bank Limited | 1.21% | |

| IDFC First Bank Limited | 1.12% | |

| IndusInd Bank Limited | 0.91% | |

| IT - Software | 9.64% | |

| Infosys Limited | 4.52% | |

| Coforge Limited | 2.38% | |

| LTIMindtree Ltd | 1.66% | |

| Rategain Travel Technologies Limited | 1.09% | |

| Auto Components | 7.51% | |

| Schaeffler India Limited | 1.41% | |

| Minda Industries Ltd | 1.28% | |

| Sona BLW Precision Forgings Limited | 1.06% | |

| Rolex Rings Limited | 1.01% | |

| Samvardhana Motherson International Limited | 0.99% | |

| Apollo Tyres Limited | 0.98% | |

| Craftsman Automation Ltd | 0.78% | |

| Chemicals & Petrochemicals | 6.23% | |

| SRF Limited | 1.46% | |

| Atul Limited | 1.43% | |

| Aarti Industries Limited | 1.01% | |

| Anupam Rasayan India Limited | 0.88% | |

| Clean Science & Technology Limited | 0.78% | |

| Navin Fluorine International Limited | 0.67% | |

| Finance | 5.49% | |

| Bajaj Finance Limited | 2.05% | |

| Mahindra & Mahindra Financial Services Limited | 1.39% | |

| Poonawalla Fincorp Limited | 1.23% | |

| Cholamandalam Investment and Finance Company Limited | 0.82% | |

| Consumer Durables | 5.25% | |

| Titan Company Limited | 1.72% | |

| Kajaria Ceramics Limited | 1.53% | |

| Crompton Greaves Consumer Electricals Limited | 1.03% | |

| VIP Industries Limited | 0.97% | |

| Industrial Products | 4.08% | |

| POLYCAB INDIA Limited | 1.90% | |

| Bharat Forge Limited | 1.71% | |

| TIMKEN INDIA LTD | 0.46% | |

| Petroleum Products | 3.99% | |

| Reliance Industries Limited | 3.99% | |

| Retailing | 3.69% | |

| Go Fashion India Limited | 1.55% | |

| Trent Limited | 1.40% | |

| FSN E-Commerce Ventures Limited | 0.73% | |

| Aerospace & Defense | 3.54% | |

| Bharat Electronics Limited | 1.26% | |

| MTAR Technologies Limited | 1.24% | |

| Hindustan Aeronautics Limited | 1.04% | |

| Leisure Services | 3.49% | |

| Jubilant Foodworks Limited | 1.24% | |

| The Indian Hotels Company Limited | 1.13% | |

| Devyani International Limited | 1.12% | |

| Cement & Cement Products | 3.33% | |

| JK Cement Limited | 2.19% | |

| The Ramco Cements Limited | 1.14% | |

| Automobiles | 3.23% | |

| TVS Motor Company Limited | 1.76% | |

| Tata Motors Limited | 1.47% | |

| Pharmaceuticals & Biotechnology | 3.18% | |

| Sun Pharmaceutical Industries Limited | 1.72% | |

| Biocon Limited | 1.45% | |

| Electrical Equipment | 2.07% | |

| ABB India Limited | 2.07% | |

| Telecom - Services | 1.59% | |

| Bharti Airtel Limited | 1.59% | |

| Agricultural Commercial & Construction Vehicles | 1.56% | |

| Ashok Leyland Limited | 1.56% | |

| Healthcare Services | 1.44% | |

| Fortis Healthcare Limited | 1.44% | |

| Beverages | 1.38% | |

| United Spirits Limited | 1.38% | |

| Industrial Manufacturing | 1.29% | |

| Honeywell Automation India Limited | 1.29% | |

| Ferrous Metals | 1.17% | |

| Jindal Steel & Power Limited | 1.17% | |

| IT - Services | 1.16% | |

| Affle (India) Limited | 1.16% | |

| Fertilizers & Agrochemicals | 1.01% | |

| PI Industries Litmited | 1.01% | |

| Realty | 0.92% | |

| Phoenix Mills Limited | 0.92% | |

| Construction | 0.70% | |

| Kalpataru Power Transmission Limited | 0.70% | |

| Textiles & Apparels | 0.59% | |

| Gokaldas Exports Ltd | 0.59% | |

| Insurance | 0.55% | |

| HDFC Life Insurance Company Limited | 0.55% | |

| Financial Technology (Fintech) | 0.50% | |

| One 97 Communications Limited | 0.50% | |

| Miscellaneous | 0.00% | |

| Dharti Dredging | 0.00% | |

| Isprava Technologies Limited | 0.00% | |

| Cash & Current Assets | 0.96% | |

| Total Net Assets | 100.00% | |

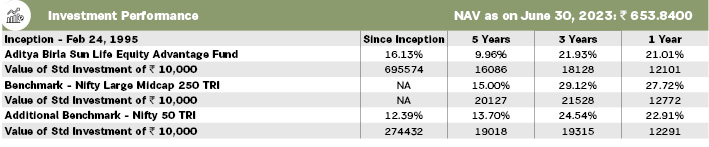

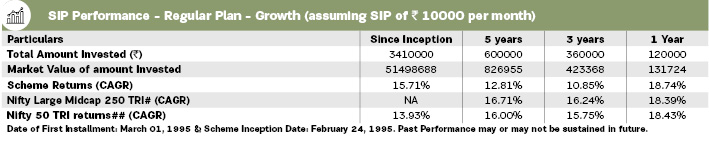

# Scheme Benchmark, ## Additional Benchmark, * As on start of period considered above. For SIP calculations above, the data assumes the investment of 10000/- on 1st day of every month or the subsequent working day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown. Past performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration. For SIP returns, monthly investment of equal amounts invested on the 1st day of every month has been considered.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

This page is a part of the July 2023 Factsheet of Aditya Birla Sun Life Mutual Fund. Click on http://empower.abslmf.com/ for the digital factsheet.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.