| Portfolio Holdings |

| Issuer |

% to net Assets |

Rating |

| Banks |

19.23% |

|

| ICICI Bank Limited |

5.31% |

|

| HDFC Bank Limited |

4.64% |

|

| Axis Bank Limited |

2.40% |

|

| State Bank of India |

2.25% |

|

| The Federal Bank Limited |

1.93% |

|

| IndusInd Bank Limited |

1.69% |

|

| Bandhan Bank Limited |

1.01% |

|

| Consumer Durables |

8.97% |

|

| Crompton Greaves Consumer Electricals Limited |

1.70% |

|

| Dixon Technologies (India) Limited |

1.62% |

|

| VIP Industries Limited |

1.60% |

|

| V-Guard Industries Limited |

1.59% |

|

| Bata India Limited |

1.26% |

|

| La Opala RG Limited |

0.35% |

|

| Blue Star Limited |

0.33% |

|

| Butterfly Gandhimathi Appliances Ltd |

0.30% |

|

| Somany Ceramics Limited |

0.14% |

|

| Johnson Controls - Hitachi Air Conditioning India Limited |

0.08% |

|

| Finance |

6.90% |

|

| Poonawalla Fincorp Limited |

2.54% |

|

| Cholamandalam Financial Holdings Limited |

1.49% |

|

| SBI Cards & Payment Services Limited |

1.15% |

|

| Bajaj Finance Limited |

0.98% |

|

| Home First Finance Company India Limited |

0.75% |

|

| Industrial Products |

5.16% |

|

| POLYCAB INDIA Limited |

2.12% |

|

| Cummins India Limited |

1.61% |

|

| TIMKEN INDIA LTD |

0.98% |

|

| Mold-Tek Packaging Limited |

0.45% |

|

| Electrical Equipment |

5.10% |

|

| TRIVENI TURBINE LTD |

1.68% |

|

| ABB India Limited |

1.52% |

|

| Hitachi Energy India Limited |

1.46% |

|

| TD Power Systems Ltd |

0.44% |

|

| Pharmaceuticals & Biotechnology |

4.14% |

|

| Sun Pharmaceutical Industries Limited |

1.51% |

|

| Biocon Limited |

1.02% |

|

| Indoco Remedies Limited |

0.74% |

|

| Ajanta Pharmaceuticals Limited |

0.69% |

|

| Aarti Pharmalabs Ltd |

0.17% |

|

| IT - Software |

4.13% |

|

| Infosys Limited |

2.72% |

|

| Coforge Limited |

1.41% |

|

| Cement & Cement Products |

4.00% |

|

| UltraTech Cement Limited |

1.63% |

|

| J.K. Lakshmi Cement Limited |

1.27% |

|

| JK Cement Limited |

1.10% |

|

| Automobiles |

3.12% |

|

| Tata Motors Limited |

1.56% |

|

| Mahindra & Mahindra Limited |

1.56% |

|

| Construction |

3.02% |

|

| Larsen & Toubro Limited |

2.06% |

|

| Ahluwalia Contracts (India) Limited |

0.96% |

|

| Healthcare Services |

2.93% |

|

| Fortis Healthcare Limited |

1.87% |

|

| Syngene International Limited |

1.06% |

|

| Food Products |

2.83% |

|

| Britannia Industries Limited |

1.47% |

|

| Zydus Wellness Limited |

0.82% |

|

| Dodla Dairy Limited |

0.54% |

|

| Leisure Services |

2.75% |

|

| Jubilant Foodworks Limited |

1.39% |

|

| The Indian Hotels Company Limited |

1.36% |

|

| Beverages |

2.71% |

|

| United Spirits Limited |

1.46% |

|

| United Breweries Limited |

1.26% |

|

| Auto Components |

2.51% |

|

| Craftsman Automation Ltd |

1.64% |

|

| Sona BLW Precision Forgings Limited |

0.88% |

|

| Retailing |

2.31% |

|

| Go Fashion India Limited |

1.09% |

|

| FSN E-Commerce Ventures Limited |

0.52% |

|

| Vedant Fashions Private Limited |

0.36% |

|

| Medplus Health Services Limited |

0.35% |

|

| Telecom - Services |

2.15% |

|

| Bharti Airtel Limited |

2.15% |

|

| Chemicals & Petrochemicals |

1.89% |

|

| Vinati Organics Limited |

1.34% |

|

| Anupam Rasayan India Limited |

0.55% |

|

| IT - Services |

1.71% |

|

| Cyient Limited |

1.71% |

|

| Realty |

1.68% |

|

| Brigade Enterprises Limited |

1.68% |

|

| Industrial Manufacturing |

1.62% |

|

| Kaynes Technology India Ltd |

0.87% |

|

| GMM Pfaudler Limited |

0.74% |

|

| Agricultural Commercial & Construction Vehicles |

1.42% |

|

| Ashok Leyland Limited |

1.42% |

|

| Insurance |

1.22% |

|

| SBI Life Insurance Company Limited |

1.22% |

|

| Non - Ferrous Metals |

1.05% |

|

| Hindalco Industries Limited |

1.05% |

|

| Power |

1.03% |

|

| NTPC Limited |

1.03% |

|

| Transport Services |

1.02% |

|

| Gateway Distriparks Limited |

0.88% |

|

| Mahindra Logistics Limited |

0.15% |

|

| Petroleum Products |

0.86% |

|

| Reliance Industries Limited |

0.86% |

|

| Entertainment |

0.33% |

|

| PVR Limited |

0.33% |

|

| Transport Infrastructure |

0.33% |

|

| Dreamfolks Services Ltd |

0.33% |

|

| Cash & Current Assets |

3.86% |

|

| Total Net Assets |

100.00% |

|

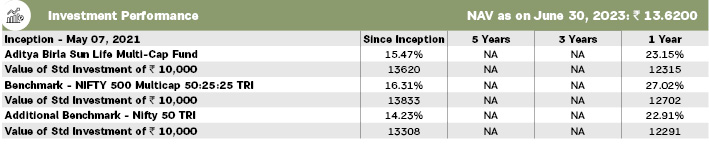

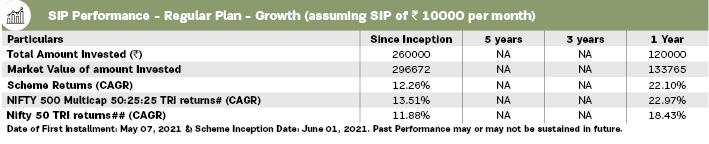

# Scheme Benchmark, ## Additional Benchmark, * As on start of period considered above.

For SIP calculations above, the data assumes the investment of

10000/- on 1st day of every month or the subsequent working day. Load & Taxes

are not considered for computation of returns. Performance for IDCW option would assume reinvestment of tax free IDCW declared at the

then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using XIRR method (investment internal rate of return).Where

Benchmark returns are not available, they have not been shown. Past performance may or may not be sustained in future. Returns greater than

1 year period are compounded annualized. IDCW are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration. For SIP

returns, monthly investment of equal amounts invested on the 1st day of every month has been considered.