| Portfolio Holdings |

| Issuer |

% to net Assets |

Rating |

| MUTUAL FUNDS |

89.87% |

|

| Aditya Birla Sun Life Low duration Fund - Growth - Direct Plan |

12.75% |

|

| Aditya Birla Sun Life Dynamic Bond Fund - Growth - Direct Plan |

9.67% |

|

| Aditya Birla Sun Life Short Term Fund - Growth - Direct Plan |

9.22% |

|

| Aditya Birla Sun Life Small Cap Fund - Growth - Direct Plan |

7.72% |

|

| Aditya Birla Sun Life Equity Advantage Fund - Growth - Direct Plan |

7.40% |

|

| Aditya Birla Sun Life Frontline Equity Fund - Growth - Direct Plan |

7.26% |

|

| Aditya Birla Sun Life Flexi Cap Fund - Growth - Direct Plan |

6.98% |

|

| Aditya Birla Sun Life Midcap Fund - Growth - Direct Plan |

6.68% |

|

| Aditya Birla Sun Life Infrastructure Fund - Growth - Direct Plan |

5.35% |

|

| Aditya Birla Sun Life Pharma and Healthcare Fund-Direct-Growth |

5.25% |

|

| Aditya Birla Sun Life Banking and Financial Services Fund - Direct Plan - Growth |

4.93% |

|

| Aditya Birla Sun Life India Gennext Fund - Growth - Direct Plan |

4.85% |

|

| Aditya Birla Sun Life International Equity Fund - Plan A - Growth - Direct Plan |

1.80% |

|

| Exchange Traded Fund |

9.07% |

|

| Aditya Birla Sun Life Gold ETF |

8.88% |

|

| Aditya Birla Sun Life Nifty ETF |

0.18% |

|

| Cash & Current Assets |

1.07% |

|

| Total Net Assets |

100.00% |

|

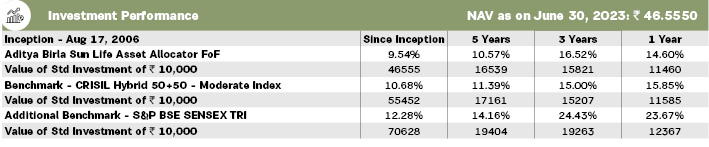

# Scheme Benchmark, ## Additional Benchmark, * As on start of period considered above.

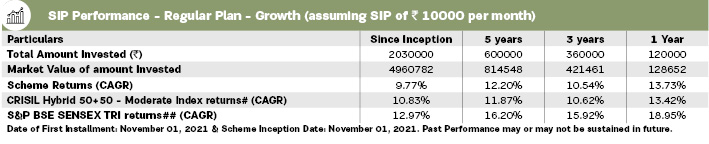

For SIP calculations above, the data assumes the investment of 10000/- on 1st day of every month or the subsequent working day. Load & Taxes

are not considered for computation of returns. Performance for IDCW option would assume reinvestment of tax free IDCW declared at the

then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using XIRR method (investment internal rate of return).Where

Benchmark returns are not available, they have not been shown. Past performance may or may not be sustained in future. Returns greater than

1 year period are compounded annualized. IDCW are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration. For SIP

returns, monthly investment of equal amounts invested on the 1st day of every month has been considered.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding

units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from

any of our Investor Service Centers.