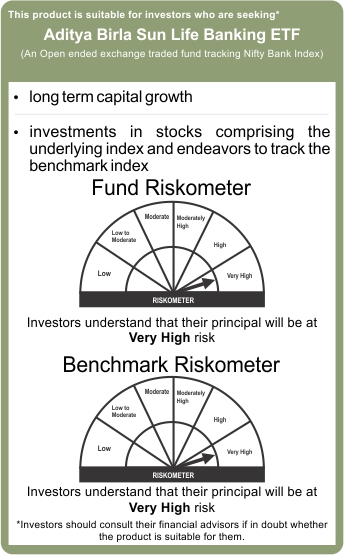

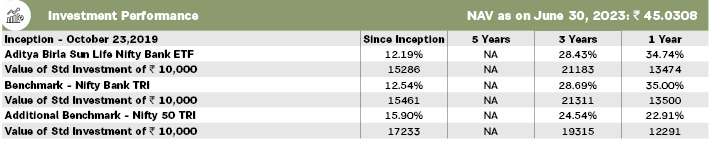

Aditya Birla Sun Life Nifty Bank ETF

An Open ended exchange traded fund tracking Nifty Bank Index

BSE Scrip Code: 542863 | Symbol: ABSLBANETF

Fund Category Exchange Traded Fund (ETF)

Investment Objective The investment objective of the Scheme is to provide returns that, before expenses, closely correspond to the total returns of the securities as represented by the Nifty Bank Index. However, the performance of scheme may differ from that of the underlying index due to tracking error. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved.