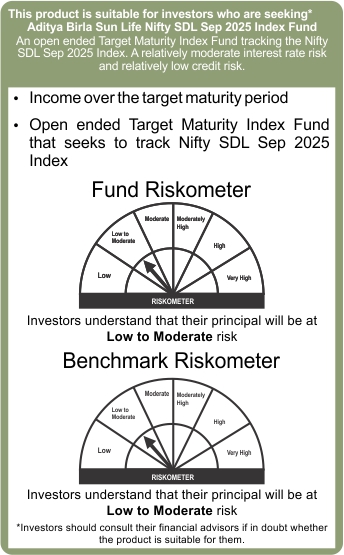

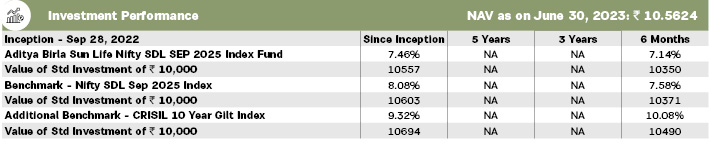

Aditya Birla Sun Life Nifty SDL Sep 2025 Index Fund

An open ended Target Maturity Index Fund tracking the Nifty SDL Sep 2025 Index. A relatively moderate interest rate risk and relatively low credit risk.

Fund Category Index Funds (Debt)

Investment Objective The investment objective of the Scheme is to generate returns corresponding to the total returns of the securities as represented by the Nifty SDL Sep 2025 Index before expenses, subject to tracking errors.

The Scheme does not guarantee/indicate any returns. There can be no assurance or guarantee that the investment objective of the Scheme will be achieved.